- 100% Compliant

- Expert CAs

- 6000+ Clients

Startup India Registration That Opens Doors!

in {{mpg_area}}, {{mpg_city}}

Unlock Tax Benefits, Government Tenders & DPIIT Recognition!

Let India’s most trusted legal experts handle your registration from start to finish.

6000+

Happy Clients

14+

Years Experience

Get Your Startup Registered Today in {{mpg_area}}, {{mpg_city}}

Fill the form below and let our experts take care of your tax return.

Get Free Consultation 🔥

Experts will review your case personally

What is Startup India?

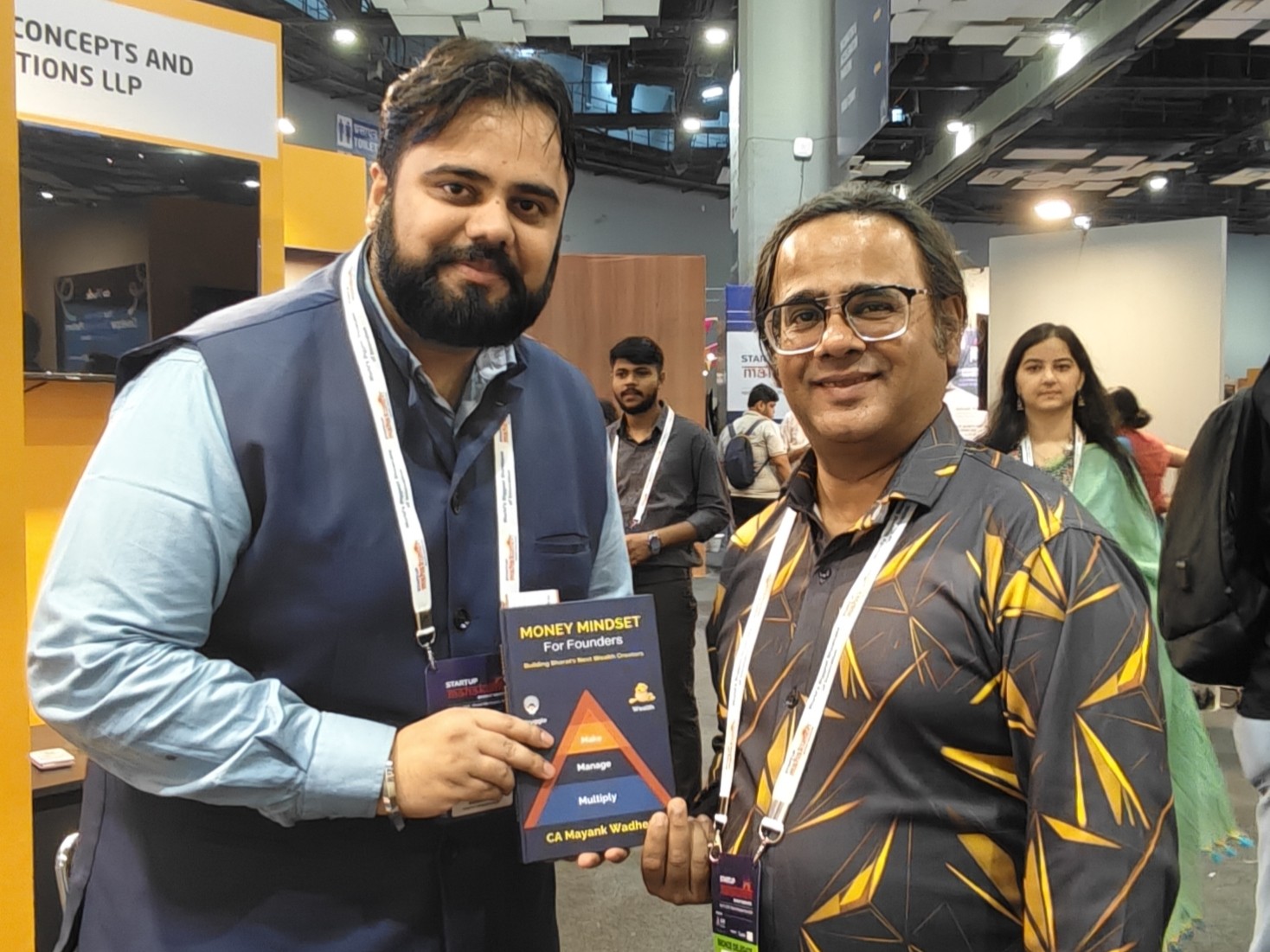

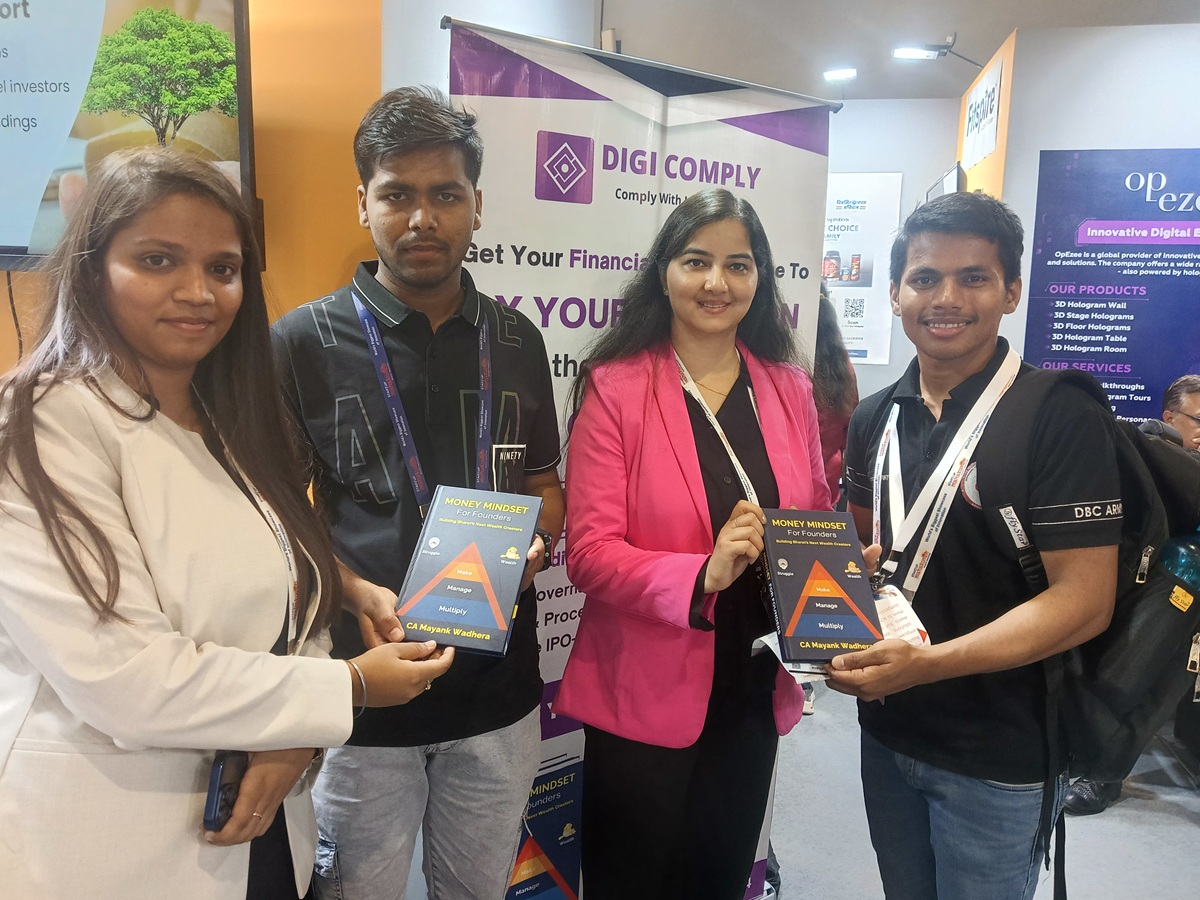

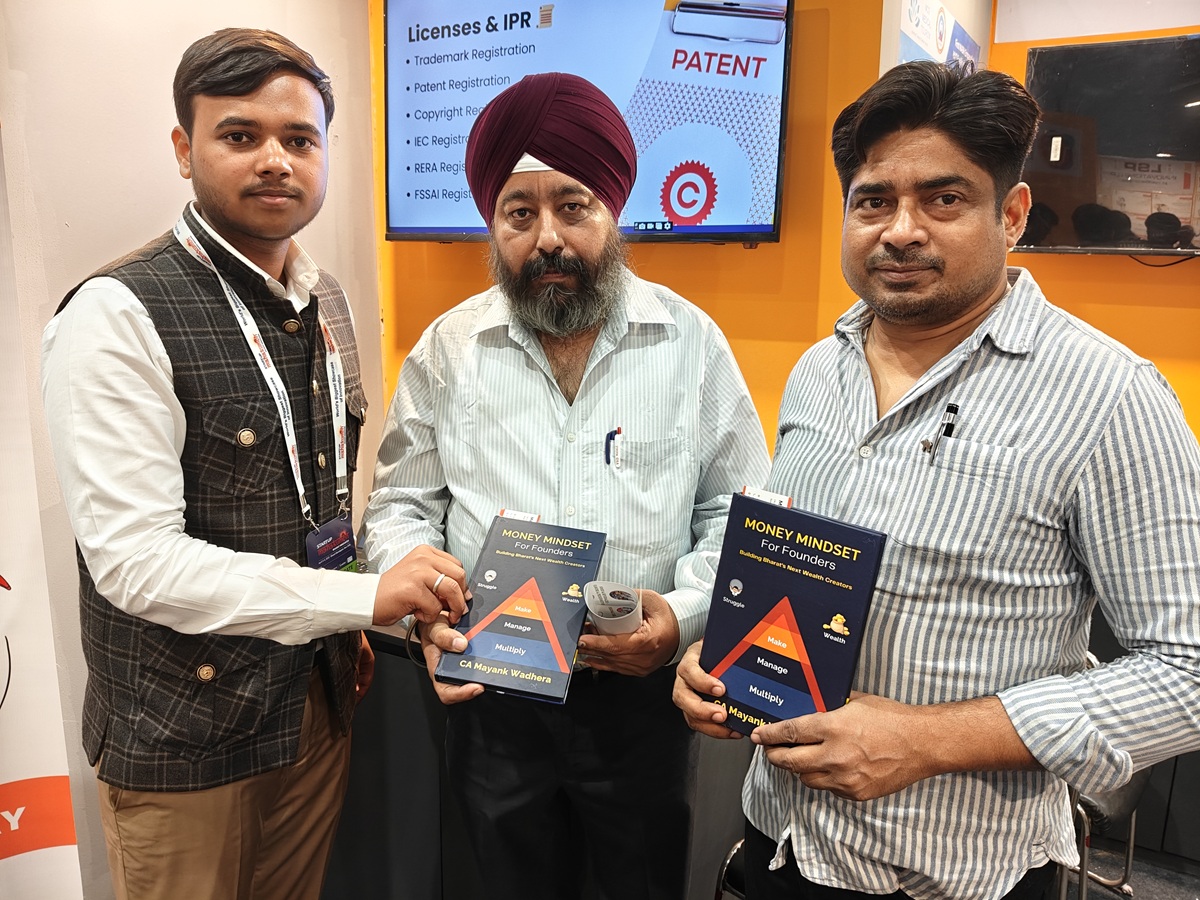

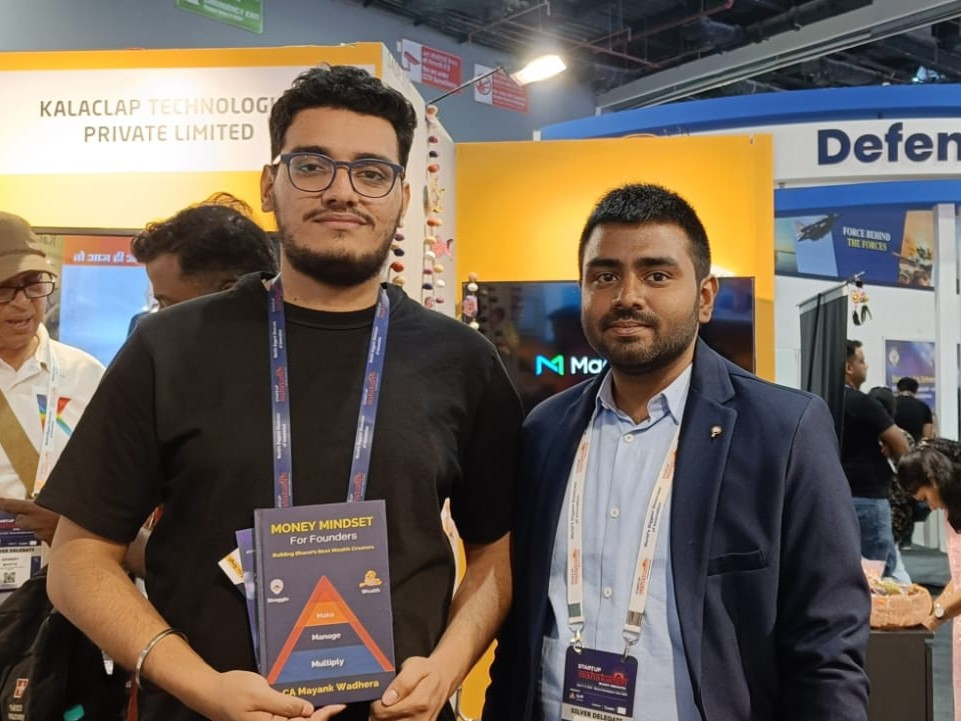

Real People. Real Stories. Real Impact.

Don’t just take our word for it. Here’s what business owners say about our services.

What You Loose If You Not Registering Under Startup India

No Tax Exemption

You lose eligibility for the 3-year income tax holiday under 80-IAC.

Funding Challenges

You miss government-recognized startup tag which VCs prefer.

No Access to Govt Tenders

Most public procurement favors DPIIT-recognized startups.

Missed Schemes

No access to Startup India seed fund, patent rebates & incentives.

Real Case Example

“XYZ Technologies missed DPIIT registration. Despite being innovative and scalable, they lost ₹12L worth of tenders and investor attention.”

Don’t let this happen to your venture.

Every day of delay = More lost opportunities!

Complete Startup India Registration Service in {{mpg_area}}, {{mpg_city}}

Quick Turnaround

We complete the DPIIT registration process within 3–5 working days* after receiving all documents.

Eligibility Guidance

Our experts assess your startup's structure and activities to ensure it qualifies under DPIIT norms.

Application Accuracy

We carefully prepare and review your application to maximize approval chances and less errors.

How Legal Suvidha Makes Startup India Registration Effortless

What You Get With Our Service

- Complete Startup India + DPIIT Registration

- Eligibility Verification & Documentation

- Business Deck/Pitch Help if required

- End-to-End DPIIT Portal Support

- Recognition Certificate Issuance

- Certified CA/CS Guidance

Free Consultation

Our CA expert reviews your company's specific requirements and compliance status.

Documents

We help you gather all necessary documents and information required for filing.

Professional Filing

Our experienced CAs prepare and file all required forms accurately, timely.

Acknowledgment

You receive official acknowledgments and compliance certificates.

Overview of Startup India in {{mpg_area}}, {{mpg_city}}

Income Tax refers to the levy imposed on the total earnings accumulated over a specific financial year, calculated based on the applicable tax slabs and government-prescribed rates.

An Income Tax Return (ITR) is essentially a formal declaration of all income earned during the year, used to assess the tax liability or determine any eligible refunds from the government. Filing an ITR is a legal obligation for a wide range of taxpayers — including individual residents, NRIs (Non-Resident Indians), partnership firms, LLPs, companies, and trusts. The return can either be filed online through e-filing or submitted manually, depending on preference and eligibility. At Legal Suvidha Providers, we simplify this process by offering end-to-end assistance to ensure your ITR is filed accurately, on time, and in full compliance with the latest tax laws.

Advantages of Startup India Registration in {{mpg_area}}, {{mpg_city}}

| Required to Secure Loan Applications | Banks usually require Income Tax Acknowledgments for the past 2-3 years while processing education, home, or personal loans. Without filing returns on time, getting loan approvals becomes difficult. |

| For VISA and Immigration Processing | ITR acknowledgments validate an individual’s financial background. Immigration processes typically demand 2-3 years of Income Tax Return proofs. |

| When Claiming Excess Tax Refund | Filing ITR is mandatory to recover any excess TDS paid. |

Process of Startup India Registration in {{mpg_area}}, {{mpg_city}}

| ITR-1, commonly called SAHAJ | It applies to an individual having: • salary or pension income or income from one house property (excluding brought forward loss) or income from other sources (excluding lottery winnings and income from race horses). • Exempt income without limit (except agricultural income above Rs. 5000) |

| ITR-2 | Applicable to an individual or Hindu Undivided Family (HUF) earning income from sources other than “Profits and gains of business or profession”. |

| ITR 2A | For individuals or HUFs earning salary and from more than one house property, excluding capital gains and business/professional income. |

| ITR – 3 | Applicable to individuals or HUFs who are partners in a firm and have income chargeable under “Profits or gains of business or profession”, excluding income by way of interest, salary, bonus, commission, or remuneration received from such firm. |

| ITR – 4S | For individuals and HUFs who have chosen presumptive taxation schemes under section 44AD/44AE. |

| ITR 4 | For individuals or HUFs engaged in proprietary business or professional activities. |

| ITR – 5 | Used mainly by partnership firms; intended for entities other than individuals, HUFs, companies, and those filing ITR-7. |

| ITR 6 | For companies excluding those exempted under section 11 (charitable or religious trusts). |

| ITR 7 | Filed by individuals and entities such as political parties, news agencies, universities, and those with income from charitable/religious trust properties. |

| ITR V | It is the acknowledgment of filing of return of income. |

Documents Required For Startup India Registration in {{mpg_area}}, {{mpg_city}}

Certificate of Registration

Ensure submission of valid incorporation certification depending on your entity type, whether it’s a private limited company, LLP, or registered partnership.

Contact Information

You need to provide reliable contact information, including mobile number and email address.

Company Information

You must disclose core information such as your firm’s field, category, and contact location.

Proof of Concept (If applicable)

If your startup has some traction or early validation, you should upload a pitch deck, video demo, or site URL.

Director/Partner Information

Disclose full profiles of founding members, including identification documents, emails, mobile numbers, and addresses.

Authorized Representative Information

Include the authorized person’s credentials—name, role, and communication details.

Revenue Model & Differentiation

Detail your business model and how your product/service stands apart from competitors.

PAN Details

PAN information of the business entity is a necessary requirement.

Short Business Description

Give a clear and brief description of your startup’s uniqueness and problem-solving capacity.

FAQ's on Startup India Registration in {{mpg_area}}, {{mpg_city}}

Form 16 is a certificate issued by employers showing the tax deducted at source (TDS) from your salary. It is crucial for filing accurate income tax returns.

Legalsuvidha's Office

Our Credibility:

Helped

6000+ Businesses

Experience

14+ Years

Rating

4.9 / 5 Star

Share this Service:

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Our Testimonials

People Who loved our services!

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Trustindex verifies that the original source of the review is Google. Great experience with smooth process during the startup india registration Excellent coordination and teamwork with effective implementation in very limited timeTrustindex verifies that the original source of the review is Google. Sound expertise, good coordination, efficient and timely execution.Trustindex verifies that the original source of the review is Google. Good service and very helpfulTrustindex verifies that the original source of the review is Google. We had a great experience working with the LegalSuvidha team - we have used them for both our Pvt Ltd and LLP formation and their team has been very proactive, knowledgeable, prompt and helpful. They helped with all DSCs as well and couriered them to us. Very professional and thorough. We also got our Startup India , MSME registrations through them promptly. Overall highly recommended. Special callout to Nidhi, Saloni, Anjalin, Shreya and Priyanka for promptly helping us throughout the process.Trustindex verifies that the original source of the review is Google. I am writing to thank you for the quality of service provided by your company. We sincerely appreciate your efficient, gracious customer service, the level of detail and accountability you have demonstrated and the way you conduct business as a whole. A special Thanks to Ms Saloni for her great help throughout.Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

Compliance Checklist to Get Funded by Angel Investors in 2025

Compliance Checklist for Getting Funded by Angel Investors or VCs You Built the Dream. But Investors Still Said No. You...

How to Legally Onboard Foreign Talent in Indian Startups

How to Legally Onboard Foreign Talent in Indian Startups The Dream of Hiring Globally India’s startup ecosystem is booming. From...

Section 80-IAC Tax Holiday: Eligibility, Process, and Pitfalls

Section 80-IAC Tax Holiday: Eligibility, Process, and Pitfalls A Shocking Tax Secret Most Founders Miss Startup founders, what if I...

Co-Founder Agreement Essentials: Must-Have Clauses & Templates

Co-Founder Agreement Essentials: Must-Have Clauses & Templates Why Every Startup Needs a Co-Founder Agreement Starting a business with someone you...

Trademark vs. Copyright vs. Patent: What Every Founder Must Know

Trademark vs. Copyright vs. Patent: What Every Founder Must Know What Every Founder Needs to Know First Your billion-dollar idea...

Startup Compliance in India: The Ultimate 2025 Guide

Startup Compliance in India: The Ultimate 2025 Guide Startups Don’t Fail for Ideas — They Fail for Ignorance You didn’t...