- 100% Compliant

- Expert CAs

- 6000+ Clients

GST Registration Made Effort Less!

in Ghutku, BILASPUR

For Startups, MSMEs, Freelancers & Small Businesses

Get Your GST Number Online with Expert Help – No Errors, No Delays

6000+

Happy Clients

14+

Years Experience

GST Registration in Ghutku, BILASPUR

Fill the form below and get a call from our experts team.

Get Free Consultation 🔥

Experts will review your case personally

About GST Registration in Ghutku, BILASPUR

Registering for GST is a legal requirement for companies in India with a turnover of over Rs. 20 lakhs per year. The process involves gather the required documents, file an online application, and cover the cost of GST registration. Once you’ve completed, you will receive a GST registration certificate from the government.

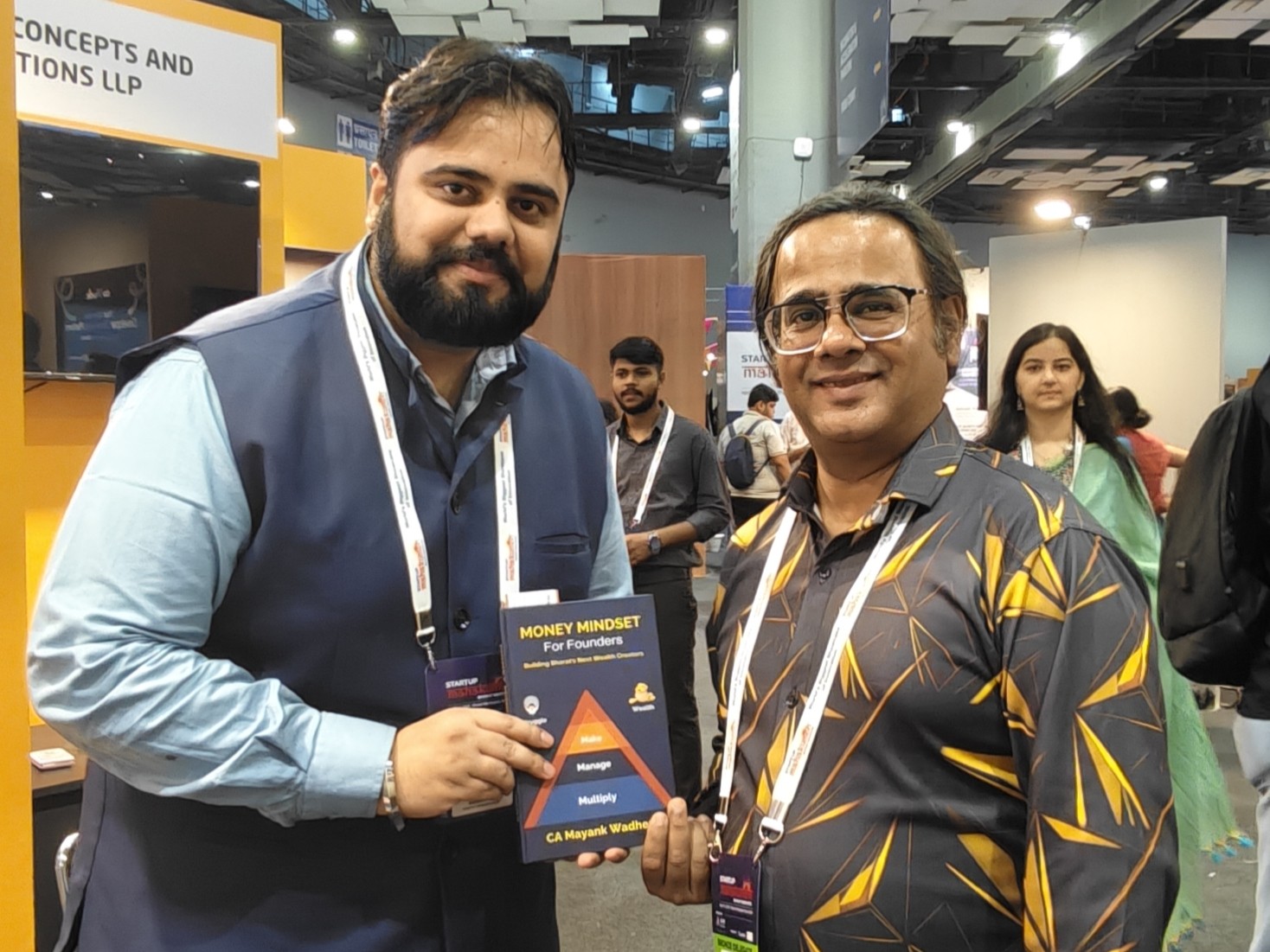

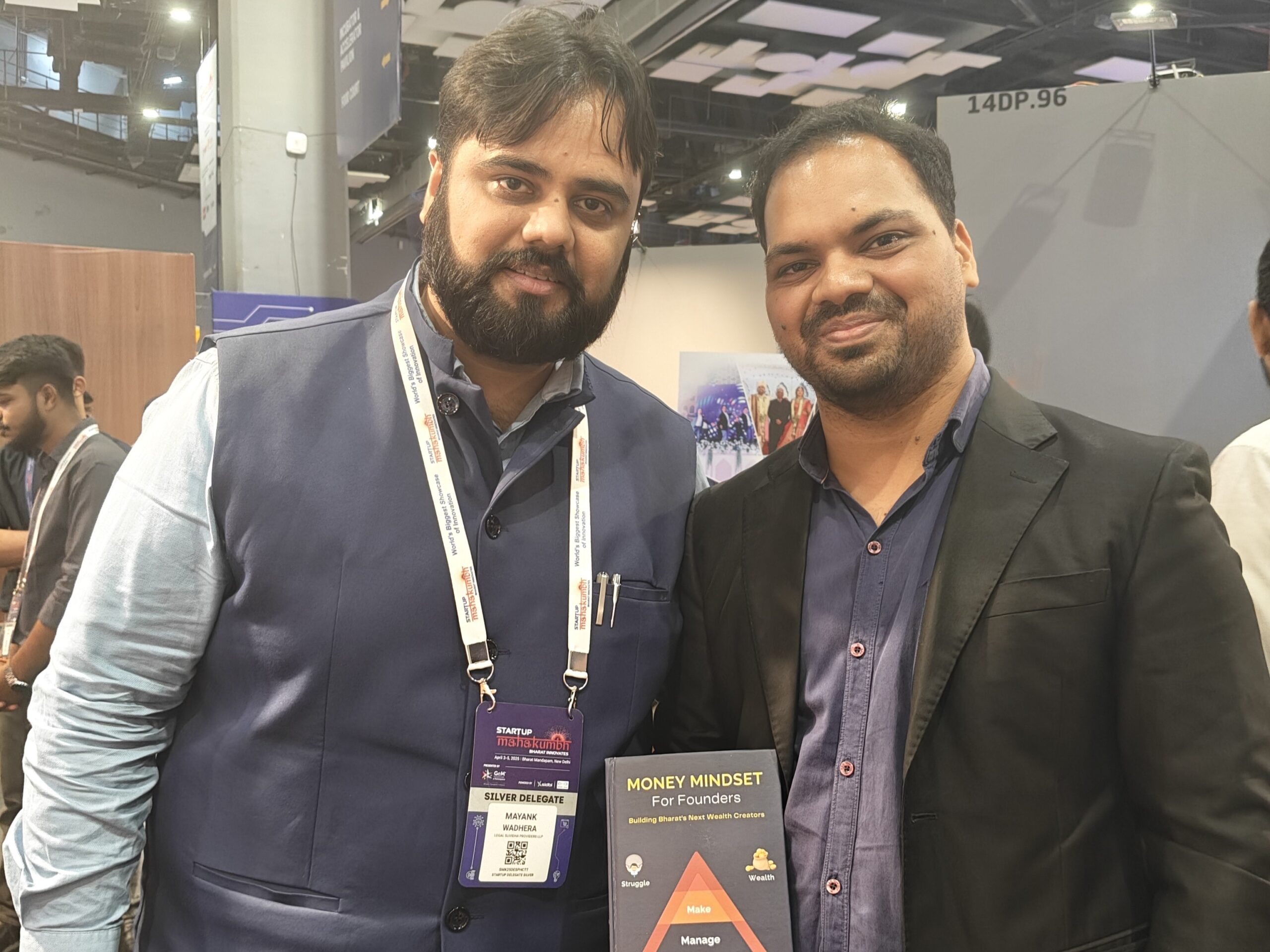

Real People. Real Stories. Real Impact.

Don’t just take our word for it. Here’s what business owners say about our services.

Risks of Not Registering For GST

Fill out the form to get professional GST filing, document validation, and registration assistance.

Mandatory for Legal Compliance

Avoid penalties, stay eligible for business tenders & government contracts.

Claim Input Tax Credit

Get refund for GST paid on purchases and expenses.

Invoice Legally with GSTIN

Collect and claim GST, issue invoices, and file returns without issues.

Sell Online & Across India

E-commerce, inter-state, and B2B billing all require valid GSTIN.

Real Case Example

“A marketing freelancer from Hyderabad needed GST urgently to onboard a corporate client. We filed her application, validated documents, and delivered GSTIN in just 5 working days ”

Don’t delay. Register Smartly!

Start your GST journey now fast, error-free, and fully compliant.

What You Get With Our GST Registration Service in Ghutku, BILASPUR

Our team take care of your application, review your documents, and get your GSTIN fast — so you can begin invoicing & remain GST-compliant.

GSTIN in Just 3–5 Days

Superfast processing with proactive follow-up.

Verified & Uploaded

We format, check, and upload PAN, Aadhaar, etc..

Expert-Filed GST

Filed correctly with 0% rejection risk.

How Legal Suvidha Handles GST Registration for You

From document pickup to filling out the GST portal form to tracking your application — we handle the end-to-end process till you receive your GST number.

What You Get With Our Service

- Application Filing on GST Portal

- Document Preparation & Upload

- GSTIN Generation & ARN Tracking

- Business Category Mapping

- Invoice & Filing Advisory

Free Consultation

Our CA expert reviews your company's specific requirements and compliance status.

Documents

We help you gather all necessary documents and information required for filing.

Professional Filing

Our experienced CAs prepare and file all required forms accurately, timely.

Acknowledgment

You receive official acknowledgments and compliance certificates.

Overview of GST Registration in Ghutku, BILASPUR

From July 1, 2017, GST replaced various Central and state-level indirect taxes like VAT, ST, Excise Duty, etc. Businesses that were enrolled under these previous systems need to transition to GST as per the migration scheme of their respective State Governments.

Under the Goods and Services Tax structure, GST registration is compulsory for all commercial entities involved in the business of selling goods or offering services, with an annual turnover exceeding Rs.10 lakhs in the NE and hilly regions, while the limit is Rs.20 lakhs for the rest of India.

Those without GST registration will not be permitted to collect GST from customers or claim ITC, and if they violate this, they will be fined. Apart from this limit, the GST Act also lists various other cases where registration is compulsory, such as supply under RCM, selling via online platforms, etc., regardless of turnover.

- Please note GST registration must be filed within 30 days from the date you become eligible for registration.

- The penalty for non-payment and short payment of tax is set at the rate of ten percent of tax due, subject to a maximum Rs. 10,000. If there is intentional avoidance of tax, then the penalty can be equal to the tax due.

- Tax professionals at Legal Suvidha will support you on the applicability and compliances under GST for your business.

- They will support you in the required process to get GST-compliant and get your GST registration certificate.

- Legal Suvidha Providers can help you get registered for GST in India. The average time to complete GST registration is about five to seven business days, depending on government approval speed and client document submission.

Advantages of GST Registration in Ghutku, BILASPUR

| Authorisation To Collect Tax | Only those who are registered under GST are permitted to collect GST from customers on goods, services, or both, and claim ITC |

| Single Platform | GST in India has streamlined indirect taxes, and a single registration is enough for the relevant state(s) to cover supplies of goods and services. |

| One nation one Tax | Under GST, several taxes such as Central Sales Tax, Purchase Tax, and others were replaced by a single tax system, simplifying tax collection and making compliance easier across the nation. |

| Simplified Business Operations | With GST, there’s no need to differentiate between goods and services, easing the burden on businesses. Restaurants, computer sales, and service-based businesses no longer need to comply with VAT and Service Tax separately. |

| Growth of Taxpayer Numbers | GST’s value addition principle has resulted in new businesses registering, benefiting from the flow of input tax credits through the supply chain. |

| Tax Reduction | GST liability is applicable only once the turnover exceeds Rs.10 lakhs for north-eastern and hilly states, and Rs.20 lakhs for the rest of the country, ultimately reducing tax payments for smaller businesses. |

Process of GST Registration in Ghutku, BILASPUR

Step 1: Submit GST Enrollment Details: To get temporary ID and login credentials which is provided to every registered taxpayer, and once you share with us the Provisional ID and password provided to you, Legal Suvidha professionals will access to the GST Common Portal and will fill the Enrollment Application.

Step 2: Submit Enrollment Details: Once you provide all the mandatory files, we will complete the signature and submission of the Enrollment Application with the relevant files electronically.

Step 3: GST Registration: After validation of the application form, If details are satisfactory an ARN code will be generated in ‘Under Review’ status. The status of provisional ID will update to “Approved” on the appointed date and a provisional GSTIN certificate will be issued.

Documents Required For GST Registration in Ghutku, BILASPUR

1. Provisional ID provided by the governing department

2. Password provided by the relevant department

3. Working email address

4. Active mobile number

5. Evidence of business structure:

If it’s a partnership – Partnership Agreement

In the case of other forms: Business registration certificate

6. Image of the promoters/partners/Karta in case of HUF

7. Document showing appointment of the authorized signatory

8. Photo of the authorized signatory

Bank passbook or statement’s opening page showing the following details:

1. Bank account details

2. Address of branch

3. Address of account holder

4. Some transaction history

FAQ's on GST Registration in Ghutku, BILASPUR

GST is a unified tax charged on manufacture, trade, and services across India. Starting from July 1, 2017, GST replaced several existing Centre and State-level indirect taxes such as VAT, Service Tax, Excise, and others. GSTIN is a 15-digit state-wise identification number based on PAN to be used to distinguish businesses that are registered under GST.

GST provisions apply if your annual turnover is Rs. 20 lakh or more. For North Eastern states and hilly areas such as Himachal Pradesh, Uttarakhand, Jammu & Kashmir, and Sikkim, the threshold limit is Rs. 10 lakhs.

GST registration cannot be completed without a PAN. Non-resident individuals, however, can apply using alternate documents.

An existing taxpayer refers to an entity already registered under laws such as VAT, Central Excise Act, or Service Tax Act.

Taxpayers already enrolled under any of the existing Acts must migrate to GST. Enrolling for GST will facilitate a seamless transition to the GST framework. Since existing data with tax authorities is insufficient, new enrolment is necessary. Additionally, this will update the GST database with the latest taxpayer data, eliminating the need for amendments

It is possible for the GST enrolment application to be rejected. In case incorrect details have been furnished or uploaded fake or incorrect documents have been attached with the Enrolment Application. The applicant will be given a chance to present their case before the application is finalized.

After enrolment, mobile number and email address can be changed by adhering to the amendment process.

The Provisional Registration Certificate will be available for viewing and download at the Dashboard of the GST Common Portal on the appointed date. The certificate will be available only if the Registration Application was submitted successfully

The final Registration Certificate will be issued within 6 months of verification of documents by authorized Center/ State officials of the concerned Jurisdiction(s) after the appointed date

Legalsuvidha's Office

Our Credibility:

Helped

6000+ Businesses

Experience

14+ Years

Rating

4.9 / 5 Star

Share this Service:

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Our Testimonials

People Who loved our services!

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

5 Essential Legal SaaS Startup Rules: Avoid Penalties Globally

5 Essential Legal SaaS Startup Rules: Avoid Penalties Globally "83% of SaaS Startups Face Legal Action Within First 24 Months"...

5 Essential AI Usage Policy Steps for Startups (+Free Template)

5 Essential AI Usage Policy Steps for Startups (+Free Template) "87% of Startups Using AI Face Legal Blind Spots -...

Avoid Costly Penalties: 2025 Data Transfer Compliance Checklist

Avoid Costly Penalties: 2025 Data Transfer Compliance Checklist 85% of Indian Businesses Aren’t Ready for This Data Regulation Tsunami India’s...

7 Essential AI Compliance Readiness Strategies to Avoid Penalties

7 Essential AI Compliance Readiness Strategies to Avoid Penalties "62% of Indian Businesses Face Regulatory Action Due to Poor AI...

5 Critical Open Source Compliance Do’s and Don’ts (Avoid Legal Blunders)

5 Critical Open Source Compliance Do’s and Don’ts (Avoid Legal Blunders) “83% of Companies Use Open Source Code Without Proper...

5 Critical Differences: Convertible Notes vs. CCDs in 2025 (Tax Risks)

5 Critical Differences: Convertible Notes vs. CCDs in 2025 (Tax Risks) "78% of Startups Face Penalties for Mismanaging Convertible Debt"...