- 100% Compliant

- Expert CAs

- 6000+ Clients

GST Registration Made Effort Less!

in Karmadiya, BHAVNAGAR

For Startups, MSMEs, Freelancers & Small Businesses

Get Your GST Number Online with Expert Help – No Errors, No Delays

6000+

Happy Clients

14+

Years Experience

GST Registration in Karmadiya, BHAVNAGAR

Fill the form below and get a call from our experts team.

Get Free Consultation 🔥

Experts will review your case personally

About GST Registration in Karmadiya, BHAVNAGAR

GST registration is mandatory for businesses in India with a turnover of over Rs. 20 lakhs per year. This includes collect the required documents, submit an online application, and cover the cost of GST registration. Once you finish, you will be issued a government-issued GST certificate from the government.

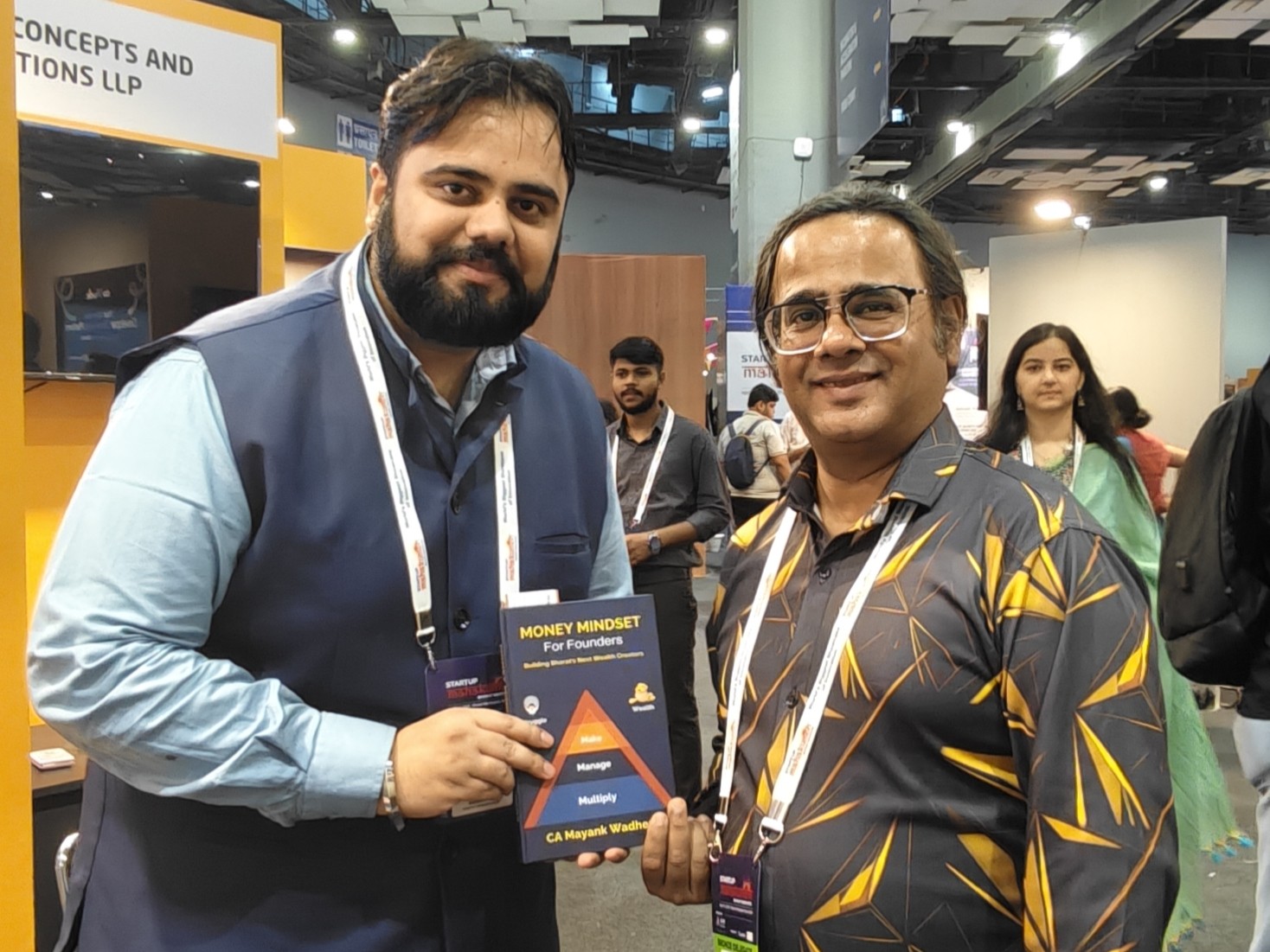

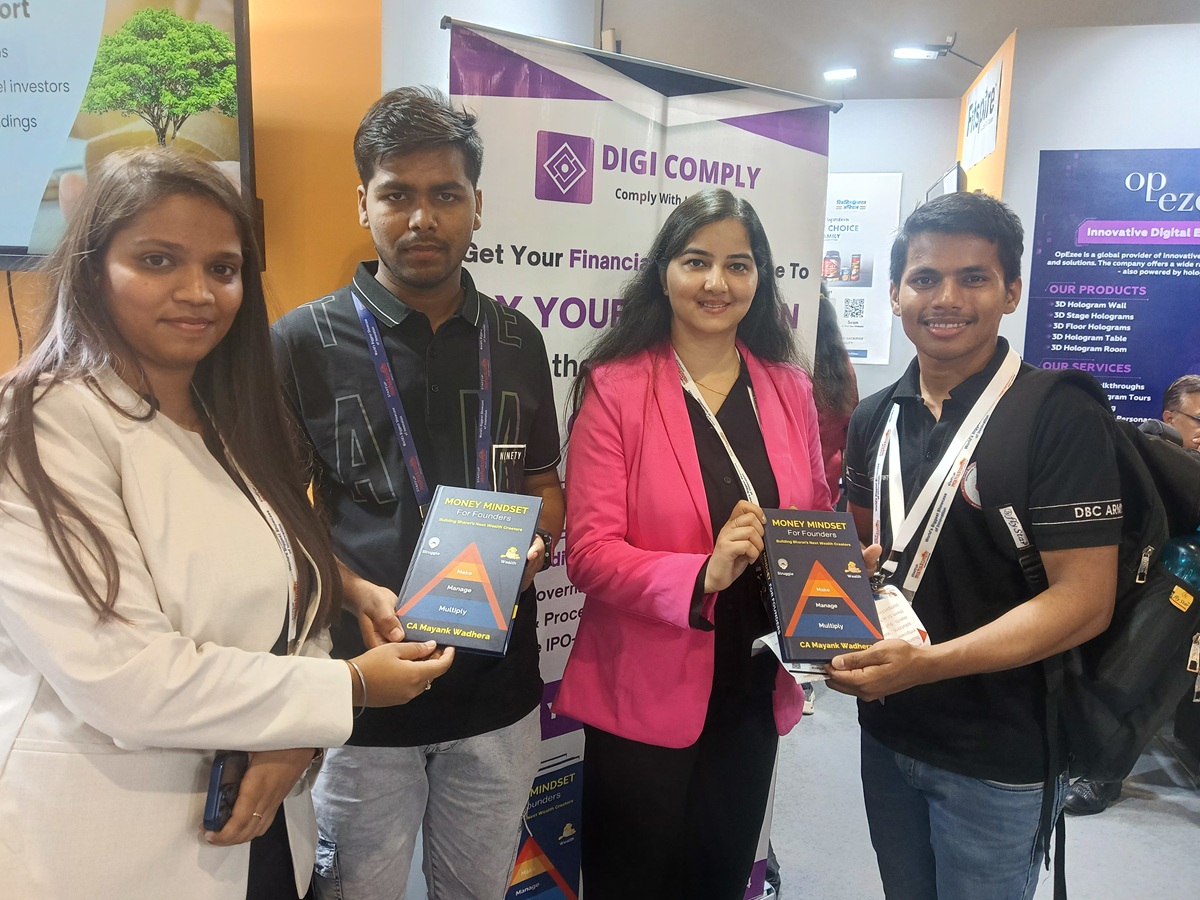

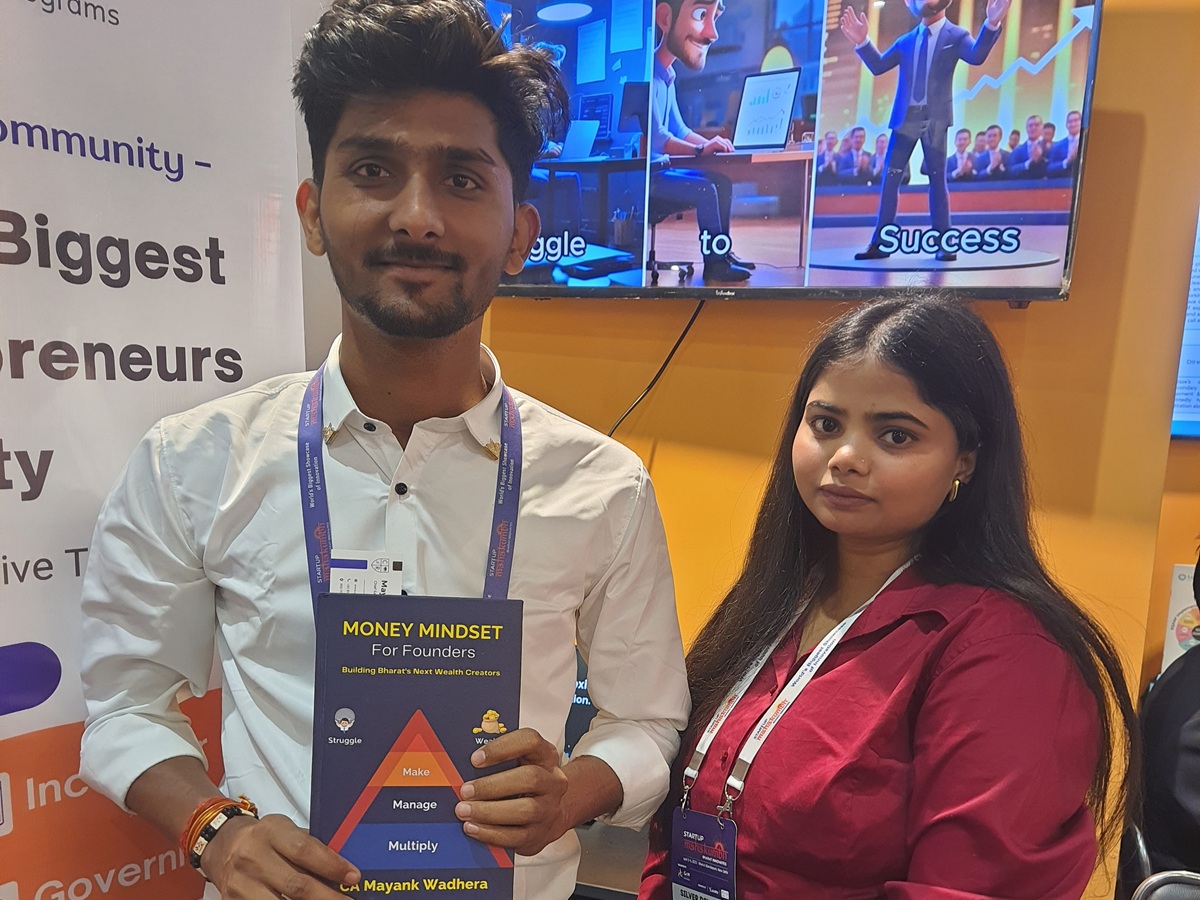

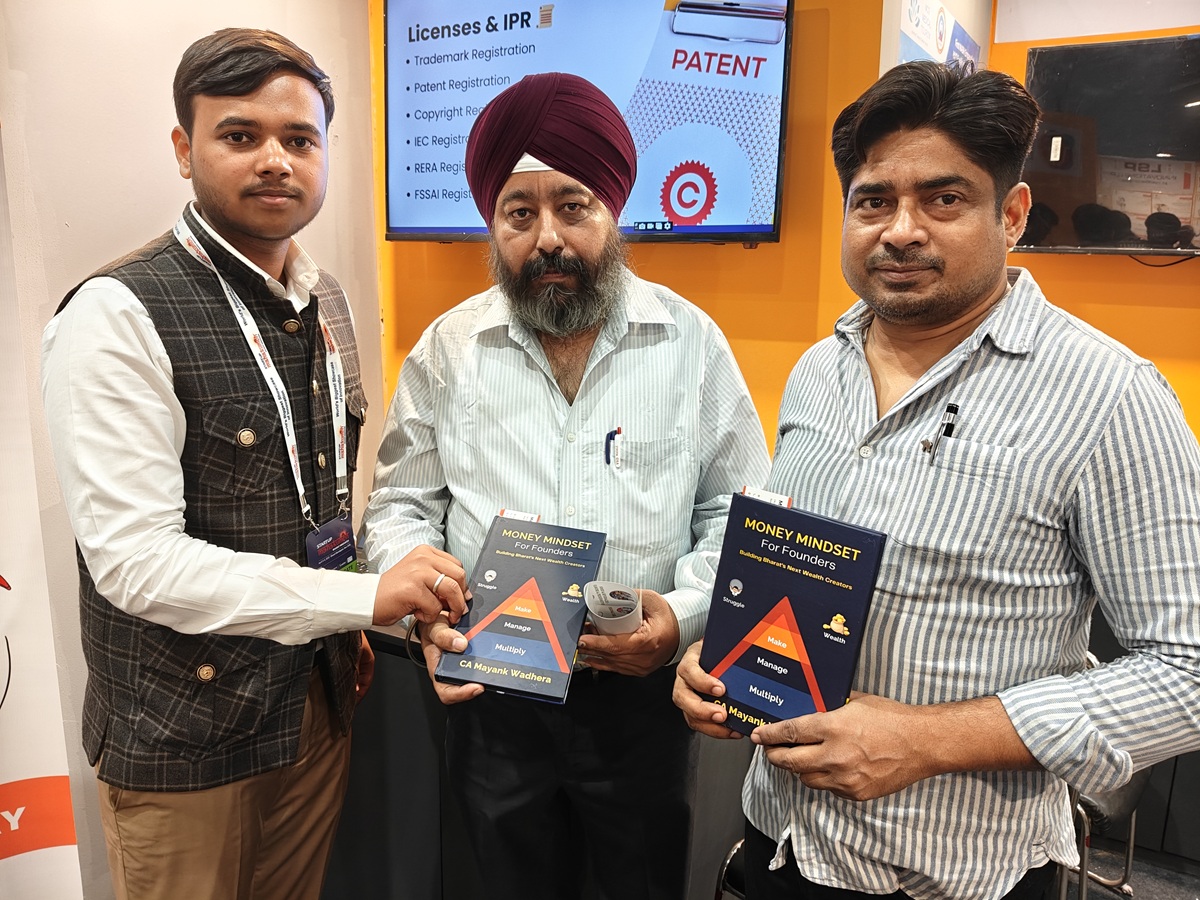

Real People. Real Stories. Real Impact.

Don’t just take our word for it. Here’s what business owners say about our services.

Risks of Not Registering For GST

Fill out the form to get expert filing, document validation, and registration assistance.

Mandatory for Legal Compliance

Avoid penalties, stay eligible for business tenders & government contracts.

Claim Input Tax Credit

Get refund for GST paid on purchases and expenses.

Invoice Legally with GSTIN

Collect and claim GST, issue invoices, and file returns without issues.

Sell Online & Across India

E-commerce, inter-state, and B2B billing all require valid GSTIN.

Real Case Example

“A marketing freelancer from Hyderabad needed GST urgently to onboard a corporate client. We filed her application, validated documents, and delivered GSTIN in just 5 working days ”

Don’t delay. Register Smartly!

Start your GST journey now fast, error-free, and fully compliant.

What You Get With Our GST Registration Service in Karmadiya, BHAVNAGAR

We create your GST registration form, inspect your documents, and get your GST registration done swiftly — so you can raise invoices & remain GST-compliant.

GSTIN in Just 3–5 Days

Superfast processing with proactive follow-up.

Verified & Uploaded

We format, check, and upload PAN, Aadhaar, etc..

Expert-Filed GST

Filed correctly with 0% rejection risk.

How Legal Suvidha Handles GST Registration for You

From collecting your paperwork to portal filing to tracking your application — we oversee the complete process till you are assigned a GSTIN.

What You Get With Our Service

- Application Filing on GST Portal

- Document Preparation & Upload

- GSTIN Generation & ARN Tracking

- Business Category Mapping

- Invoice & Filing Advisory

Free Consultation

Our CA expert reviews your company's specific requirements and compliance status.

Documents

We help you gather all necessary documents and information required for filing.

Professional Filing

Our experienced CAs prepare and file all required forms accurately, timely.

Acknowledgment

You receive official acknowledgments and compliance certificates.

Overview of GST Registration in Karmadiya, BHAVNAGAR

From 1st July 2017, GST substituted various Central and state-level indirect taxes like VAT, ST, Central Excise, etc. Businesses that were enrolled under these previous systems need to shift to GST as per the enrolment plan of their respective State Governments.

Under the current GST system, GST registration is required for all enterprises involved in the supply of goods or services, with an annual turnover more than Rs.10 lakhs in north-eastern and hill states, while the limit is Rs.20 lakhs for the remaining regions.

Unregistered persons will not be permitted to levy GST from customers or claim ITC, and if they ignore this, they will be fined. Apart from this turnover criterion, the GST Act also lists various other cases where registration is compulsory, such as supply under RCM, e-commerce aggregator involvement, etc., irrespective of their turnover.

- Please note GST registration must be applied for within 30 days from the date you become eligible for registration.

- The penalty for non-payment and short payment of tax is determined at the rate of ten percent of tax due, capped at Rs. 10,000. If there is intentional avoidance of tax, then the penalty can be equal to the tax due.

- Our GST consultants will guide you on the rules and requirements under GST for your business.

- They will assist you in the procedural formalities to get registered and obtain your GSTIN.

- The GST professionals can help you get registered for GST in India. The average time required to receive GST registration is about five to seven business days, subject to government approval speed and client paperwork readiness.

Advantages of GST Registration in Karmadiya, BHAVNAGAR

| GST Collection Authorization | Only those who are registered under GST are permitted to collect GST from customers on goods, services, or both, and claim ITC |

| Unified Platform | GST in India has streamlined indirect taxes, and a single registration is enough for the relevant state(s) to cover supplies of goods and services. |

| Unified Tax Structure | With the advent of GST, taxes like Central Sales Tax, Additional Customs Duty, and Luxury Tax have been replaced, streamlining tax collection and making compliance simpler for businesses. |

| Simplified Business Operations | With GST, there’s no need to differentiate between goods and services, easing the burden on businesses. Restaurants, computer sales, and service-based businesses no longer need to comply with VAT and Service Tax separately. |

| Growth of Taxpayer Numbers | GST works on the value addition concept and it is the reason that new registrations have come into existence to take benefit of Input Tax in the Transaction chain. GST allows a seamless flow of input tax credits. |

| Tax Reduction | Under the GST regime, GST liability accrues only if an entity crosses an annual turnover of Rs.10 lakhs in northeast or hilly states, whereas, for the rest of India, the threshold is set at Rs.20 lakhs which ultimately leads to lower tax payment. |

Process of GST Registration in Karmadiya, BHAVNAGAR

Step 1: Fill GST Enrollment Application: To get initial ID and password which is provided to every GST-registered individual, and once you submit the initial ID and password provided to you, our expert team will sign in to the GST Common Portal and complete the GST registration form.

Step 2: Submission of Enrollment Application: Once you submit all the required documents, we will electronic submission of the Enrollment Application with the relevant files electronically.

Step 3: Obtain GSTIN: After validation of the submitted details, If information is accurate an registration reference number will be provided to you in ‘Pending’ status. The status of provisional ID will be updated to “Approved” on the appointed date and a temporary GST certificate will be issued.

Documents Required For GST Registration in Karmadiya, BHAVNAGAR

1. Provisional ID provided by the governing department

2. Password obtained by the concerned department

3. Valid email address

4. Active mobile number

5. Evidence of business structure:

In case of partnership deed – Partnership Deed

In the case of others: Registration Certification of the business entity

6. Photograph of promoters/partners/Karta of HUF

7. Document showing appointment of the authorized signatory

8. Picture of the appointed signatory

Bank passbook or statement’s opening page showing the following details:

1. Bank account details

2. Details of branch address

3. Address of account holder

4. A few recent transaction details

FAQ's on GST Registration in Karmadiya, BHAVNAGAR

The Goods and Services Tax (GST) is a unified tax levied on manufacture, trade, and services across India. GST, which took effect from 1st July 2017, replaced a wide range of indirect taxes such as VAT, Service Tax, and Excise, both at the Centre and State levels. GSTIN is a 15-character state-wise PAN-based number to be used to distinguish businesses that are registered under GST.

GST provisions apply if your annual turnover is Rs. 20 lakh or more. For North Eastern states and hilly areas such as Himachal Pradesh, Uttarakhand, Jammu & Kashmir, and Sikkim, the threshold limit is Rs. 10 lakhs.

PAN is mandatory to apply for GST registration. Non-resident individuals, however, can apply using alternate documents.

Existing taxpayers are entities that are already registered under applicable State or Central laws such as VAT, Service Tax, and Central Excise Act.

All taxpayers currently registered under the specified Acts must transition to GST. Enrolling for GST will facilitate a seamless transition to the GST framework. Due to incomplete data with tax authorities, a fresh enrolment process is planned. Additionally, this will update the GST database with the latest taxpayer data, eliminating the need for amendments

It is possible for the GST enrolment application to be rejected. The application can be rejected if false details or incorrect documents are provided. However, the applicant taxpayer will be provided a reasonable opportunity of being heard where the applicant taxpayer can present his or her viewpoints.

Yes, the registered mobile number and e-mail address can be updated post-enrolment by following the amendment procedure

The Provisional Registration Certificate will be available for viewing and download at the Dashboard of the GST Common Portal on the appointed date. The provisional certificate will be available for download only if the application for registration was completed successfully.

The final registration certificate will be provided within 6 months following the verification of documents by the authorized officials after the appointed date.

Legalsuvidha's Office

Our Credibility:

Helped

6000+ Businesses

Experience

14+ Years

Rating

4.9 / 5 Star

Share this Service:

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Our Testimonials

People Who loved our services!

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

5 Crucial Steps: Annual Compliance Checklist for Private Limited Companies (2025 Guide)

5 Crucial Steps: Annual Compliance Checklist for Private Limited Companies (2025 Guide) 73% of Indian Companies Paid Penalties Last Year...

Statutory Registers for Startups: 5 Must-Follow Maintenance Rules

Statutory Registers for Startups: 5 Must-Follow Maintenance Rules “78% of Startup Penalties Stem From Simple Record-Keeping Errors” A recent Ministry...

5 Steps to File DIR-3 KYC & DIN Compliance (2025 Guide)

5 Steps to File DIR-3 KYC & DIN Compliance (2025 Guide) 3,412 Directors Disqualified Last Month - Is Your DIN...

GST for Startups: What You Must File, Track, and Automate

GST for Startups: What You Must File, Track, and Automate The Startup GST Mistake That Cost ₹10,000 We filed everything,...

FEMA, FDI & RBI Reporting: A Complete Guide for Founders

FEMA, FDI & RBI Reporting: A Complete Guide for Founders How one simple fund transfer triggered a ₹3.5 lakh fine....

Top 5 Startup Tax Deductions You‚ Are Probably Missing

Top 5 Startup Tax Deductions You’re Probably Missing Are You Overpaying Taxes Without Realizing It? Most startup founders miss legal...