- 100% Compliant

- Expert CAs

- 6000+ Clients

Income Tax Notice? Don’t Worry We'll Fix It!

in Pullad, PATHANAMTHITTA

Got an Income Tax Notice? We Help You Respond the Right Way.

Get professional help from Chartered Accountants to decode and respond to IT notices without stress.

6000+

Happy Clients

14+

Years Experience

Income Tax Notice Response in Pullad, PATHANAMTHITTA

Fill the form below and get a call from our experts team.

Get Free Consultation 🔥

Experts will review your case personally

About Income Tax Notice Response in Pullad, PATHANAMTHITTA

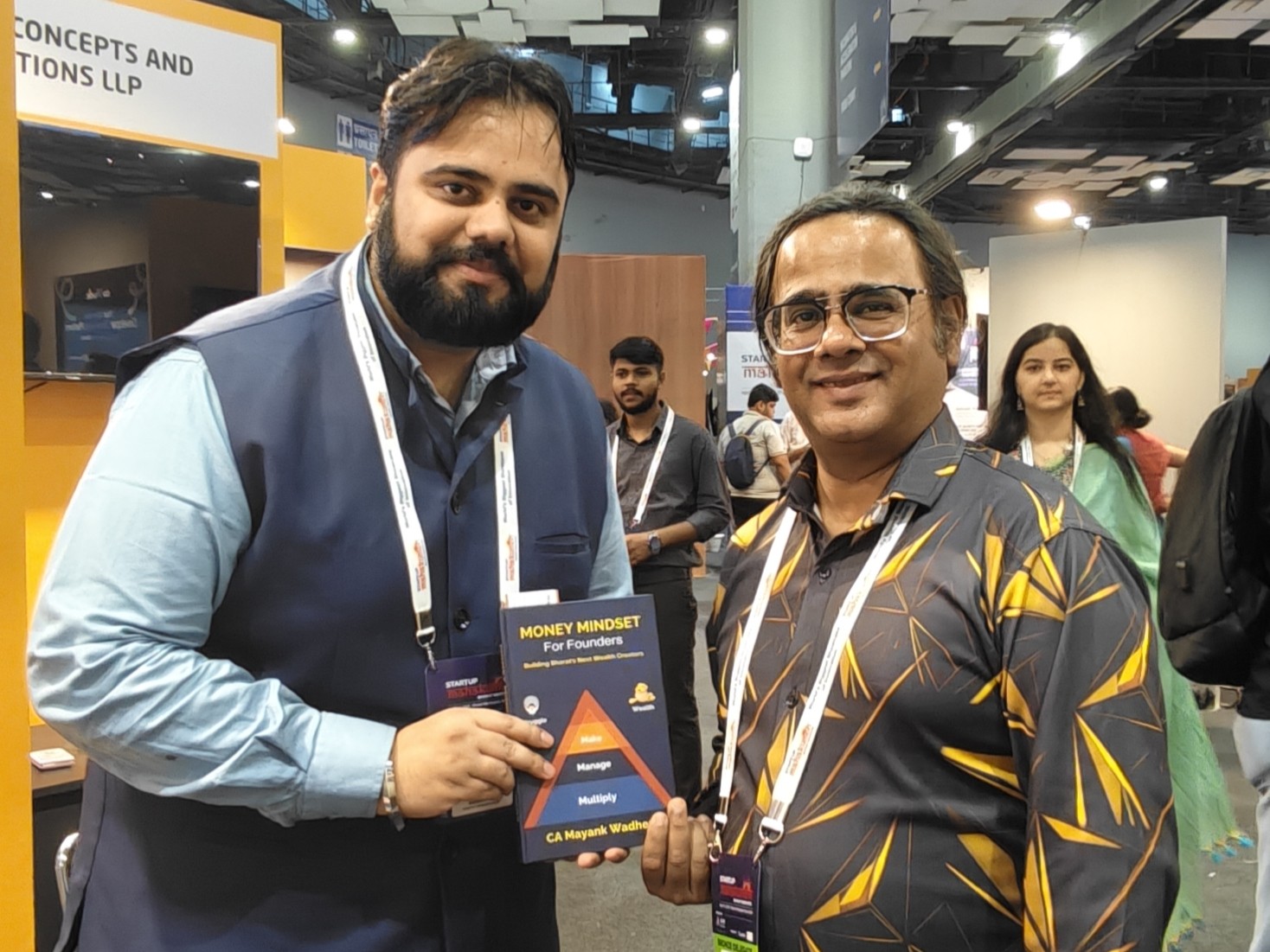

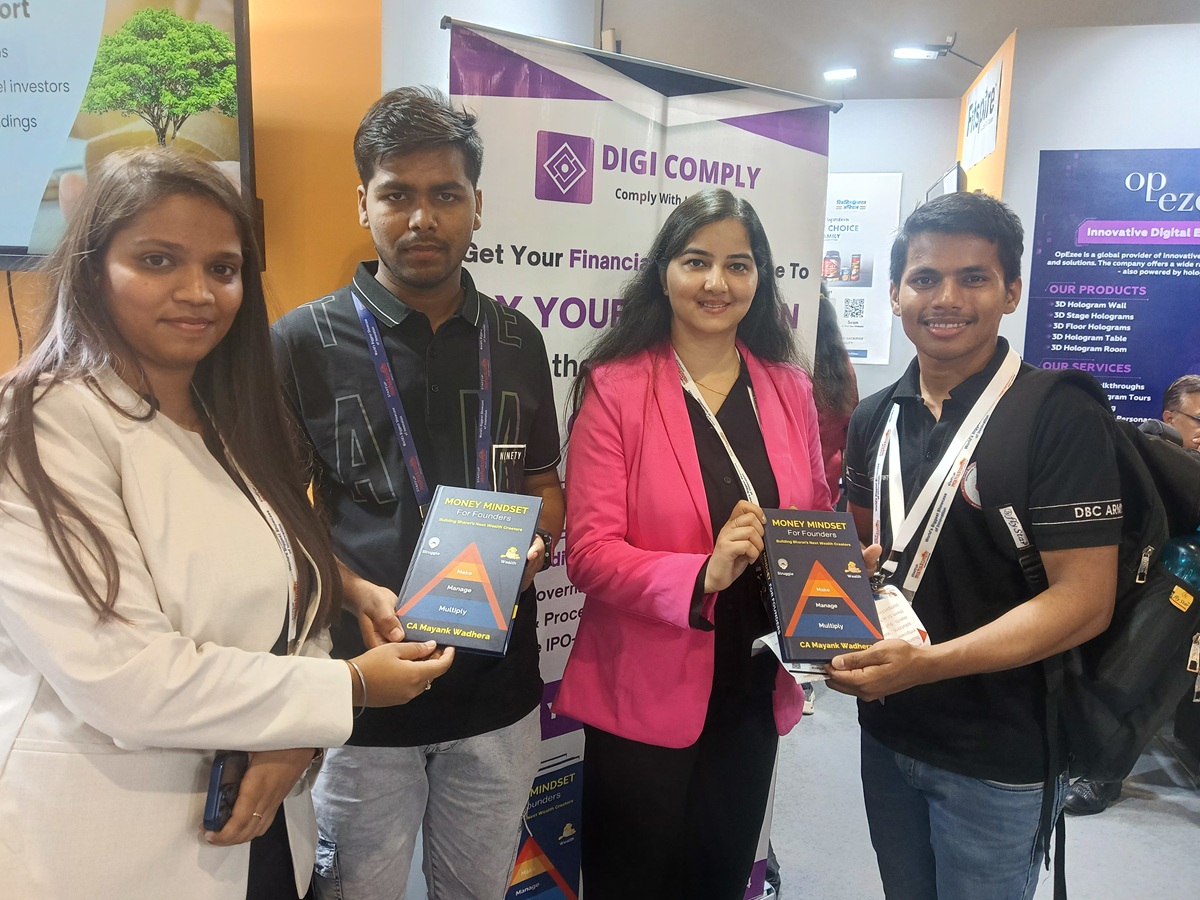

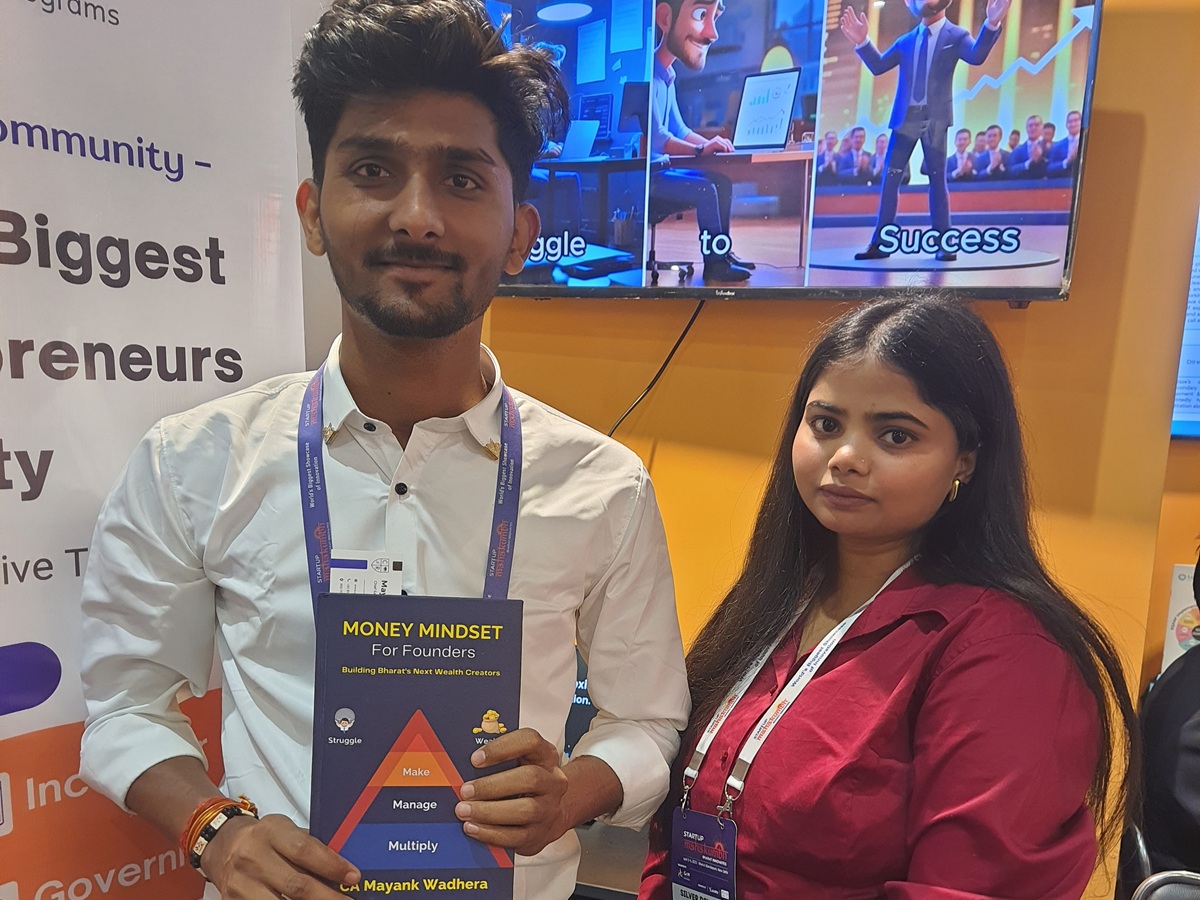

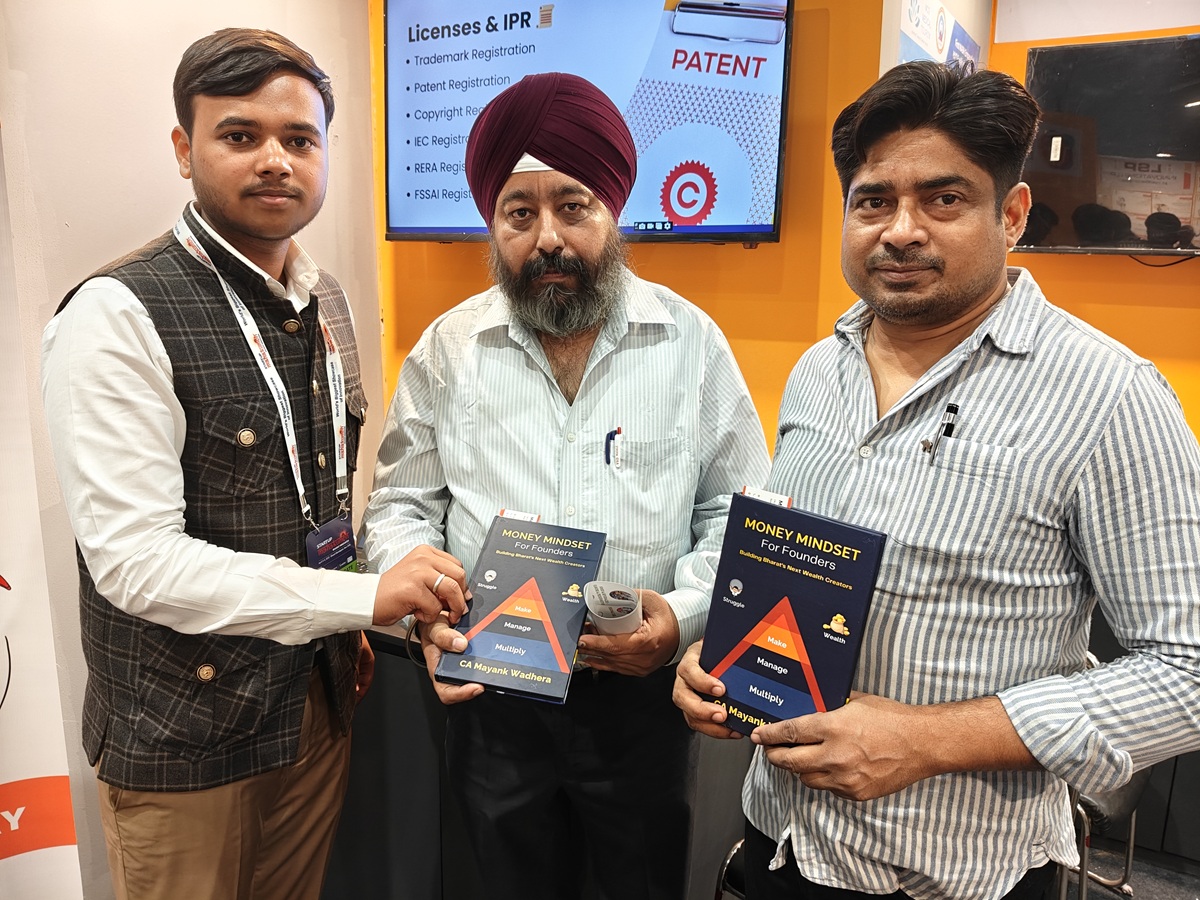

Real People. Real Stories. Real Impact.

Don’t just take our word for it. Here’s what business owners say about our services.

Risks of Ignoring or Mishandling Income Tax Notices

Penalties & Prosecution

Ignoring a notice can result in penalties of ₹10,000 to ₹1,00,000 or even legal action.

Higher Scrutiny & Audit Calls

Poorly drafted or no replies trigger further scrutiny and assessment orders.

Account Seizure or Refund Hold

Delayed replies can lead to freezing of bank accounts or IT refund being withheld.

Loss of Peace of Mind

Even minor mistakes in your return or TDS may attract severe consequences if not clarified properly.

Real Case Example

“A client received a notice for ₹8 lakh undisclosed income. After our CA’s explanation and supporting documents, the case was closed without any demand.”

Don’t panic. Respond wisely and timely.

Respond smartly or you may end up paying for others' mistakes.

What You Get With Our Income Tax Notice Response Service in Pullad, PATHANAMTHITTA

We create a law-compliant reply with supporting documents so you are completely compliant.

Quick Response

Urgent cases managed with fast turnaround to meet IT department deadlines.

Legally Drafted Response

Get a clean, CA-approved document ready for portal upload or offline submission.

Expert Reviewed

Every case is reviewed and handled by professionals with years of I-T practice.

How Legal Suvidha Handles Income Tax Notices for You

What You Get With Our Service

- Detailed Review of Notice

- Professionally Drafted Reply

- Justifications, Legal Clauses & Supporting Docs

- Assistance in Portal Filing or Physical Submission

- CA-Signed Reply + Advisory on Future Compliance

Free Consultation

Our CA expert reviews your company's specific requirements and compliance status.

Documents

We help you gather all necessary documents and information required for filing.

Professional Filing

Our experienced CAs prepare and file all required forms accurately, timely.

Acknowledgment

You receive official acknowledgments and compliance certificates.

Overview of Income Tax Notice Response in Pullad, PATHANAMTHITTA

The Income Tax Department of India issues Income Tax Notices as formal communications to Income Tax Authority of India to taxpayers due to income mismatches, non-submission of returns, TDS Form 26AS conflicts, or detailed assessments. Reassessment notices can also arise under Section 148 when the department suspects escaped income.

With our team at Legal Suvidha, we offer end-to-end, accurate, and compliant Income Tax Notice responses. Be it a clerical mistake or an extensive scrutiny under Section one forty-three (2), our tax experts perform a thorough review of your past filings, Form 26AS, AIS/TIS data, and relevant financial documents. Accordingly, we create and file a personalized response adhering to the Income Tax Act and CBDT circulars.

Our services cover notices under Sections 139(9), 143(1), 143(2), 148, 154, and 156, among several others. From refund corrections, mismatches, non-disclosure issues, to audit notices, we strive to minimize liabilities, ensure compliance, and achieve fast closure.

Advantages of Income Tax Notice Response in Pullad, PATHANAMTHITTA

- Avoid penalties, interest, and legal action through timely and precise responses

- Qualified Chartered Accountants and tax experts handling alongside tax practitioners

- Precise matching between ITR, Form 26AS, AIS/TIS, and bank/investment details

- Comprehensive representation in scrutiny and reassessment cases

- Help with rectification requests, refund follow-ups, and reassessment clarifications

- Detailed documentation and audit trail preparation to support your submission

Process of Income Tax Notice Response in Pullad, PATHANAMTHITTA

- Submit the Notice – Upload a scanned copy or PDF of your tax notice

- Initial Case Review – Review of notice details and your previous tax filings

- Gathering Supporting Documents – We gather Form 26AS, AIS/TIS, bank statements, and other supporting records

- Reply Drafting – Tailored reply addressing specific sections of the Income Tax Act

- Submission of Reply – We file the reply online through the income tax portal or guide you through the process

- Ongoing Support & Representation – Managing subsequent notices, department queries, or hearings

Documents Required For GST Notice Response in Pullad, PATHANAMTHITTA

- A clear copy of your income tax notice

- Access credentials for Income Tax e-filing portal and PAN

- Income Tax Return copies for relevant assessment years

- Form 26AS, AIS and TIS reports

- Bank statements, investment proofs, rent receipts, and salary slips (if applicable)

- Past letters or notices received from the Income Tax Department

- Profit & Loss statements, balance sheets, and income computations for businesses or professionals

FAQ's on Income Tax Notice Response in Pullad, PATHANAMTHITTA

Income tax notices are issued for several reasons such as income mismatch , failure to file returns, large financial dealings, refund issues , or audit examination. The specific reason is typically stated in the notice.

Yes, Legal Suvidha provides professional representation through qualified tax practitioners in scrutiny proceedings before the Assessing Officer or Income Tax Authorities.

Legalsuvidha's Office

Our Credibility:

Helped

6000+ Businesses

Experience

14+ Years

Rating

4.9 / 5 Star

Share this Service:

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Our Testimonials

People Who loved our services!

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

5 Crucial Steps: Annual Compliance Checklist for Private Limited Companies (2025 Guide)

5 Crucial Steps: Annual Compliance Checklist for Private Limited Companies (2025 Guide) 73% of Indian Companies Paid Penalties Last Year...

Statutory Registers for Startups: 5 Must-Follow Maintenance Rules

Statutory Registers for Startups: 5 Must-Follow Maintenance Rules “78% of Startup Penalties Stem From Simple Record-Keeping Errors” A recent Ministry...

5 Steps to File DIR-3 KYC & DIN Compliance (2025 Guide)

5 Steps to File DIR-3 KYC & DIN Compliance (2025 Guide) 3,412 Directors Disqualified Last Month - Is Your DIN...

GST for Startups: What You Must File, Track, and Automate

GST for Startups: What You Must File, Track, and Automate The Startup GST Mistake That Cost ₹10,000 We filed everything,...

FEMA, FDI & RBI Reporting: A Complete Guide for Founders

FEMA, FDI & RBI Reporting: A Complete Guide for Founders How one simple fund transfer triggered a ₹3.5 lakh fine....

Top 5 Startup Tax Deductions You‚ Are Probably Missing

Top 5 Startup Tax Deductions You’re Probably Missing Are You Overpaying Taxes Without Realizing It? Most startup founders miss legal...