GST for Startups: What You Must File, Track, and Automate

GST for Startups: What You Must File, Track, and Automate The Startup GST Mistake That Cost ₹10,000 We filed everything,...

Hazardous waste is any waste that poses a potential threat to human health or the environment. These wastes can be in the form of solids, liquids, or gases and are generated through various manufacturing and industrial activities.

Happy Clients

Years Experience

Happy Clients

Years Experience

Hazardous waste is any waste that poses a potential threat to human health or the environment. These wastes can be in the form of solids, liquids, or gases and are generated through various manufacturing and industrial activities. Hazardous waste can be classified based on their properties like biological, chemical, and physical, which make them toxic, reactive, ignitable, infectious, corrosive or radioactive. Proper hazardous waste management includes collection, recycling, treatment, disposal, and transportation of wastes, which requires proper authorization from the authority.

To export hazardous waste, individuals must obtain authorization from the appropriate authority. Hazardous waste exports from India listed in Part A & Part B of Schedule III & Schedule VI require permission from the Ministry of Environment and Forest. The list of hazardous waste that can be exported includes metal and metal-bearing waste, waste with metal carbonyls, leaching residues from zinc processing, clean uncontaminated metal scrap, paper and paperboard waste, and used multifunction print and copying machines.

| Environmental Protection | The hazardous waste export authorization helps to protect the environment and public health by ensuring that hazardous wastes are disposed of safely and responsibly |

| Legal Compliance | The authorization process ensures that all hazardous waste exports comply with international and national laws, regulations, and guidelines |

| Controlled Export | The authorization process helps to regulate the export of hazardous waste and ensures that it is exported only to countries that have the capacity to manage hazardous waste |

| Promotes Recycling | The export authorization process also promotes the recycling and recovery of hazardous waste, which helps to conserve natural resources and reduce waste disposal costs |

| International Cooperation | The authorization process promotes international cooperation and collaboration in managing hazardous waste, as it requires countries to share information and work together to protect the environment and public health |

Step 1: Report the proposed transboundary movement of hazardous waste to the Ministry of Environment and Forests using Form 1.

Step 2: Receive a ‘No Objection Certificate’ with any necessary conditions from the Central Government after authentication.

Step 3: The Central Government sends a copy of the ‘No Objection Certificate’ to the relevant State Pollution Control Board, Central Pollution Control Board, and Pollution Control Committee of the UT to ensure compliance and safe handling.

Step 4: Do not ship the consignment until the ‘No Objection Certificate’ has been issued.

Step 5: The State Pollution Control Boards or Pollution Control Committees will provisionally register the trader, and if no objections are raised within 30 days, the registration will be considered final.

Step 6: The registered trader must disclose information about the imports, actual users, and quantities to the relevant State Pollution Control Board or Pollution Control Committees every quarter.

Step 7: If the State Pollution Control Board decides to suspend, cancel, or refuse registration, the decision may be appealed in writing with a copy of the order within 30 days of the order’s date of passage.

1. IEC

2. MOA

3. AOA/Partnership deed

4. Pan Card and UID of Authorized Person

5. Pan Card of the Unit

6. GST registration

7. Permission to operate the unit

8. copy of the unit’s Authorisation from the relevant SPCB

9. A lab report for the waste that will be exported

Although customs brokers and freight forwarders frequently provide the majority of documentation, it is ultimately your responsibility as the exporter to ensure that it is accurate. It’s crucial to understand the reasons why a particular piece of equipment was chosen.

There are two major types of exporting that help businesses go global: direct and indirect exporting.

The EPA has the power to regulate hazardous waste “from the cradle to the grave” because to the Resource Conservation and Recovery Act (RCRA). This covers the production, movement, handling, handling, storage, and disposal of hazardous waste.

The U.S. Environmental Protection Agency (EPA), U.S. Occupational Safety and Health Administration (OSHA), U.S. Department of Transportation (DOT), and U.S. Nuclear Regulatory Commission all define and regulate hazardous materials (NRC).

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

We provide free of cost consultation and legal advice to our clients.

We are a team of more than 15+ professionals with 11 years of experience.

All our services are online no need you to travel from your place.

There are no hidden & extra charges* other than the quote/invoice we provide.

We aim that all our customers are fully satisfied with our services.

We value your time and we promise all our services are delivered on time.

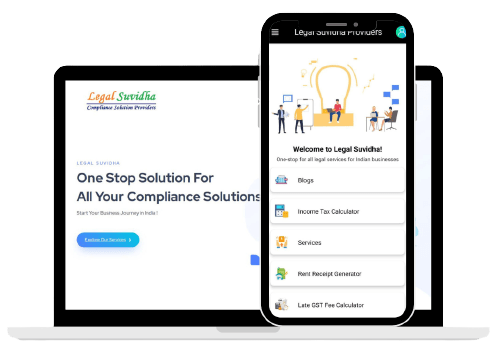

We provide free of cost consultation and legal advice to our clients.

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

GST for Startups: What You Must File, Track, and Automate The Startup GST Mistake That Cost ₹10,000 We filed everything,...

FEMA, FDI & RBI Reporting: A Complete Guide for Founders How one simple fund transfer triggered a ₹3.5 lakh fine....

Top 5 Startup Tax Deductions You’re Probably Missing Are You Overpaying Taxes Without Realizing It? Most startup founders miss legal...

A CA’s Guide to Startup Financial Statements Before Fundraise A Real Startup Fundraising Story That Went Wrong Sir, we had...

Legal Roadmap for Building a 100 Crore Startup in India The Mistake That Cost a Founder Crores I never thought...

MSME Compliance After ₹100 Crore Turnover: What Changes? The ₹100 Crore Celebration That Came with a Catch We made it...

Here are some answers to potential questions that may arise as you start your business.

Register your business, obtain necessary licenses, and fulfill tax obligations.

Consider factors like ownership, liability, and tax implications to choose from options like sole proprietorship, partnership, or company registration.

Choose a unique business name, obtain required IDs like Director Identification Number (DIN), and file incorporation documents with the Registrar of Companies (ROC).

Obtain GST registration, trade licenses, and any industry-specific permits required to operate legally.

Maintain accurate financial records, file tax returns on time, and adhere to the tax laws applicable to your business.

Yes, startups in India can benefit from various government schemes offering tax exemptions, funding support, and incubation facilities.

Secure patents, trademarks, or copyrights to safeguard your intellectual assets from infringement or unauthorized use.

Challenges include navigating bureaucratic hurdles, complying with complex regulations, and competing in a crowded marketplace.

Looking For More Information? Contact Us

Sign up to receive email updates on new product announcements, special promotions, sales & more.

Redefining the experience of legal services. Now all Professional Services in a Single Click !

Copyright © 2025 Legal Suvidha Providers LLP. All rights reserved.