Received an Income Tax Notice in India? Don’t Panic — Here’s Exactly What to Do [2025 Guide]

“Over 82 lakh income tax notices were issued in 2024 — mostly for mismatched data, not fraud.” — CBDT Annual...

Introducing GST e-Invoicing in India has paved the way for digitalization and moved away from traditional paper-based systems. The adoption of e-Invoicing can lead to significant cost savings, efficiency, and faster business operations. Using e-Invoicing also helps businesses keep up with the rest of the world. It makes them more competitive because they can adapt to changes in the market more easily. In today’s digital world, being able to send and receive invoices electronically is a big advantage. It makes businesses more flexible and better at handling new challenges.

Happy Clients

Years Experience

Happy Clients

Years Experience

GST e-Invoicing is a new system introduced in India to streamline the invoicing process for businesses. It is an electronic invoicing system that helps businesses generate, validate, and share invoices digitally. The main objective of GST e-invoicing is to bring efficiency, and transparency, and reduce the compliance burden for businesses. The system will eliminate the need for manual entry of invoice data into GST returns, input tax credit reconciliation, eWay bills, and GST refunds.

| Cost savings | e-Invoicing can help businesses save significant costs by reducing printing, postage, and manual processing expenses |

| Efficiency | e-Invoicing can speed up the invoicing process, reducing the time and effort required for manual data entry and reconciliation |

| Compliance | e-Invoicing can help reduce compliance burden by eliminating the need for duplication or transfer of information from one system to another |

| Auto-population of information | With e-Invoicing, the invoice information provided to GSTN for generating Invoice Reference Number (IRN) can be used to auto-populate various other systems such as GST returns, input tax credit reconciliation, eWay bill and GST refunds |

| Accuracy | e-Invoicing reduces the risk of errors and inaccuracies by eliminating manual data entry |

| Ease of doing business | GST e-Invoicing significantly improves the ease of doing business by reducing the compliance burden and streamlining business operations |

Step 1: Businesses with an annual turnover of Rs. 50 crores or more must generate e-Invoices for B2B transactions starting from January 1, 2021. However, voluntary compliance was allowed from October 1, 2020.

Step 2: Businesses can generate e-Invoices using their existing accounting or billing software. The invoice will be uploaded to the Invoice Registration Portal (IRP), which will validate and generate a unique Invoice Reference Number (IRN) for each invoice.

Step 3: Once an IRN is generated, the e-Invoice must be digitally signed using a digital signature or a QR code, which contains the IRN and other relevant details of the invoice.

Step 4: The supplier must provide the e-Invoice details to the recipient either by email, SMS, or any other electronic mode. The supplier can also provide a physical copy of the invoice if requested by the recipient.

Step 5: The details of e-Invoices will be auto-populated in the supplier’s and recipient’s GSTR-1 and GSTR-2 returns, respectively. The details will also be auto-populated in the e-Way bill system, making it easier for businesses to generate e-Way bills.

1. GSTIN (Goods and Services Taxpayer Identification Number)

2. IRN (Invoice Reference Number)

3. Invoice date

4. Buyer’s GSTIN

5. HSN (Harmonized System of Nomenclature) code/SAC (Services Accounting Code)

6. Taxable value and discounts, if any

7.Tax amounts for CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), IGST (Integrated Goods and Services Tax), and Cess, if any

8. Shipping and billing address of the buyer and supplier

9. Place of supply

10. Item details – description, quantity, unit, and total value

11. Signature or digital signature of the supplier

According to Rule 48(4) of the CGST Regulations, notified classes of registered persons are required to produce invoices and upload them (in the form GST INV-01) to the Invoice Registration Portal (IRP) in order to receive an Invoice Reference Number (IRN). The invoice copy that is issued by the notified supplier to the buyer following the aforementioned “e-invoicing” process, among other things, contains the IRN (with QR Code), and is referred to as a “e-invoice” in GST. The interchange of the invoice document (structured invoice data) between a supplier and a buyer in an integrated electronic format is made possible by the standard e-invoice schema (INV-01).

Businesses can benefit from e-invoices in a variety of ways, including automatic GST reporting and e-way bill preparation (where required). E-invoicing will also make standardisation and interoperability easier, which will reduce conflicts between parties to transactions, improve payment cycles, lower processing costs, and generally increase business efficiency.

As invoice generation will take place on the business end, this can be incorporated into the seller’s ERP or invoicing system. This feature is offered by the majority of such software under the names item master, supplier master, buyer master, etc.

No, the same invoice number cannot be used to create a new invoice once an IRN has been cancelled. The IRP will reject the same if it is used again.

Small businesses may be exempt from GST e-Invoicing if their annual turnover falls below the threshold specified by the government.

The GST e-Invoicing system is designed with security in mind. Data transmission and storage follow strict security protocols to protect sensitive business information.

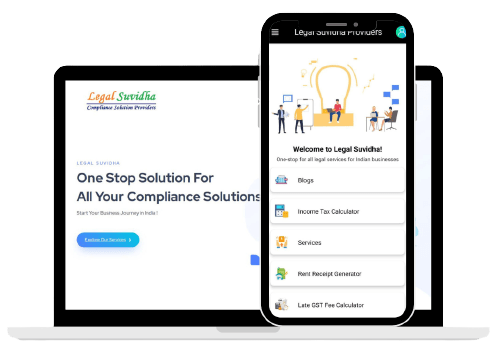

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

We provide free of cost consultation and legal advice to our clients.

We are a team of more than 15+ professionals with 11 years of experience.

All our services are online no need you to travel from your place.

There are no hidden & extra charges* other than the quote/invoice we provide.

We aim that all our customers are fully satisfied with our services.

We value your time and we promise all our services are delivered on time.

We provide free of cost consultation and legal advice to our clients.

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

“Over 82 lakh income tax notices were issued in 2024 — mostly for mismatched data, not fraud.” — CBDT Annual...

“Cybercrime cases in India crossed 1.2 million complaints in 2024 — a 54% jump from the previous year.” — National...

“Over 32,000 trademark infringement complaints were filed in India in 2024 — most by startups and SMEs.” — IP India...

“Nearly 1 in 5 property buyers in India discover title defects AFTER paying token money.” — National Land Records Survey...

“Over 41% of property disputes in India arise because buyers skipped basic legal due diligence.” — Ministry of Housing Report...

“In over 78% of custody disputes, courts do NOT grant custody based on mother vs father — but the child’s...

Here are some answers to potential questions that may arise as you start your business.

Register your business, obtain necessary licenses, and fulfill tax obligations.

Consider factors like ownership, liability, and tax implications to choose from options like sole proprietorship, partnership, or company registration.

Choose a unique business name, obtain required IDs like Director Identification Number (DIN), and file incorporation documents with the Registrar of Companies (ROC).

Obtain GST registration, trade licenses, and any industry-specific permits required to operate legally.

Maintain accurate financial records, file tax returns on time, and adhere to the tax laws applicable to your business.

Yes, startups in India can benefit from various government schemes offering tax exemptions, funding support, and incubation facilities.

Secure patents, trademarks, or copyrights to safeguard your intellectual assets from infringement or unauthorized use.

Challenges include navigating bureaucratic hurdles, complying with complex regulations, and competing in a crowded marketplace.

Looking For More Information? Contact Us

Sign up to receive email updates on new product announcements, special promotions, sales & more.

Redefining the experience of legal services. Now all Professional Services in a Single Click !

Copyright © 2025 Legal Suvidha Providers LLP. All rights reserved.