- 100% Compliant

- Expert CAs

- 6000+ Clients

Startup India Registration That Opens Doors!

in {{mpg_area}}, {{mpg_city}}

Unlock Tax Benefits, Government Tenders & DPIIT Recognition!

Let India’s most trusted legal experts handle your registration from start to finish.

6000+

Happy Clients

14+

Years Experience

Get Your Startup Registered Today in {{mpg_area}}, {{mpg_city}}

Fill the form below and let our experts take care of your tax return.

Get Free Consultation 🔥

Experts will review your case personally

What is Startup India?

Through Online Startup India Registration, startups can register with the Indian government under the Startup India program. It is designed to encourage Indian entrepreneurs by offering support, benefits, and incentives for building innovative ventures.

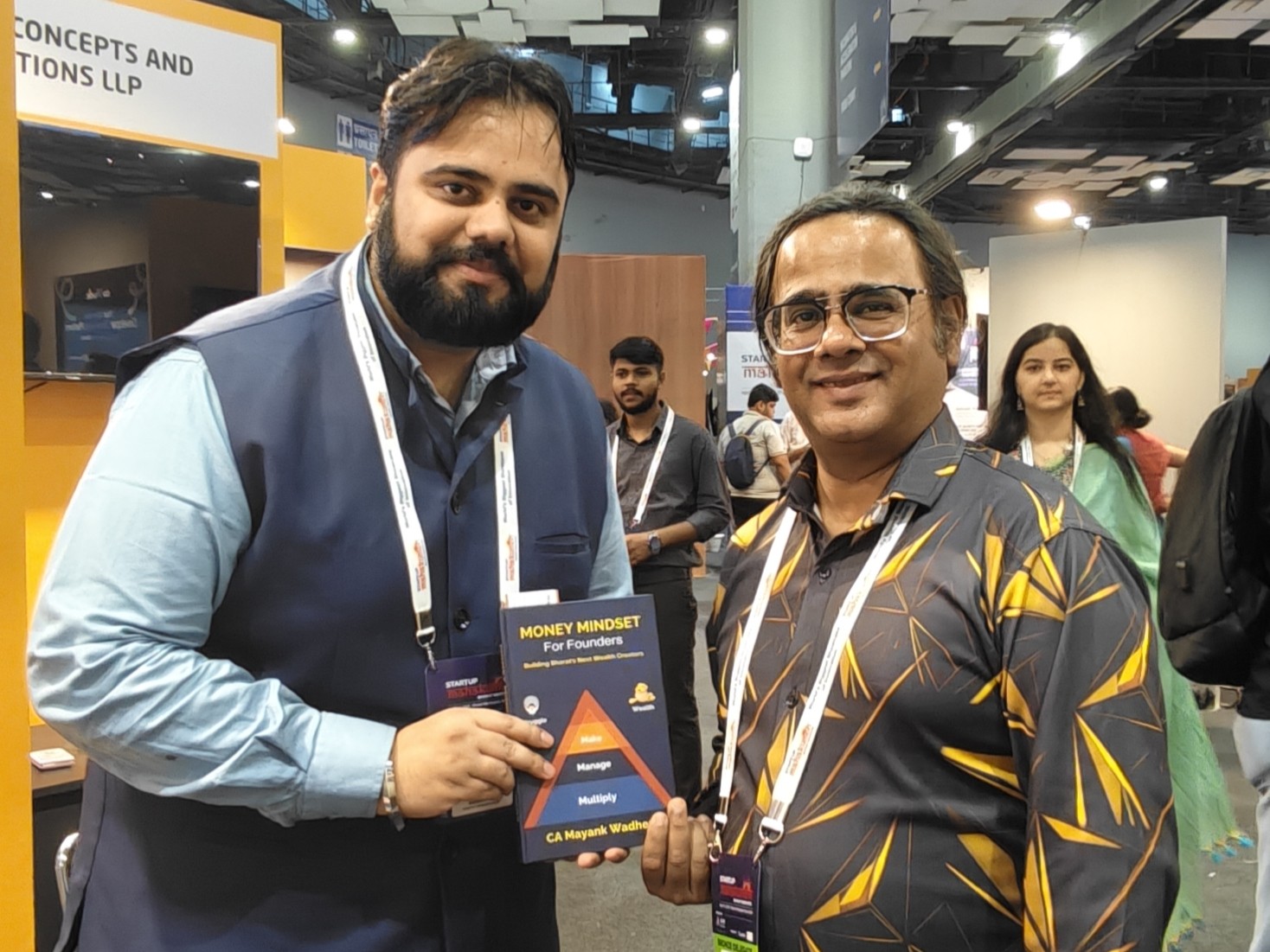

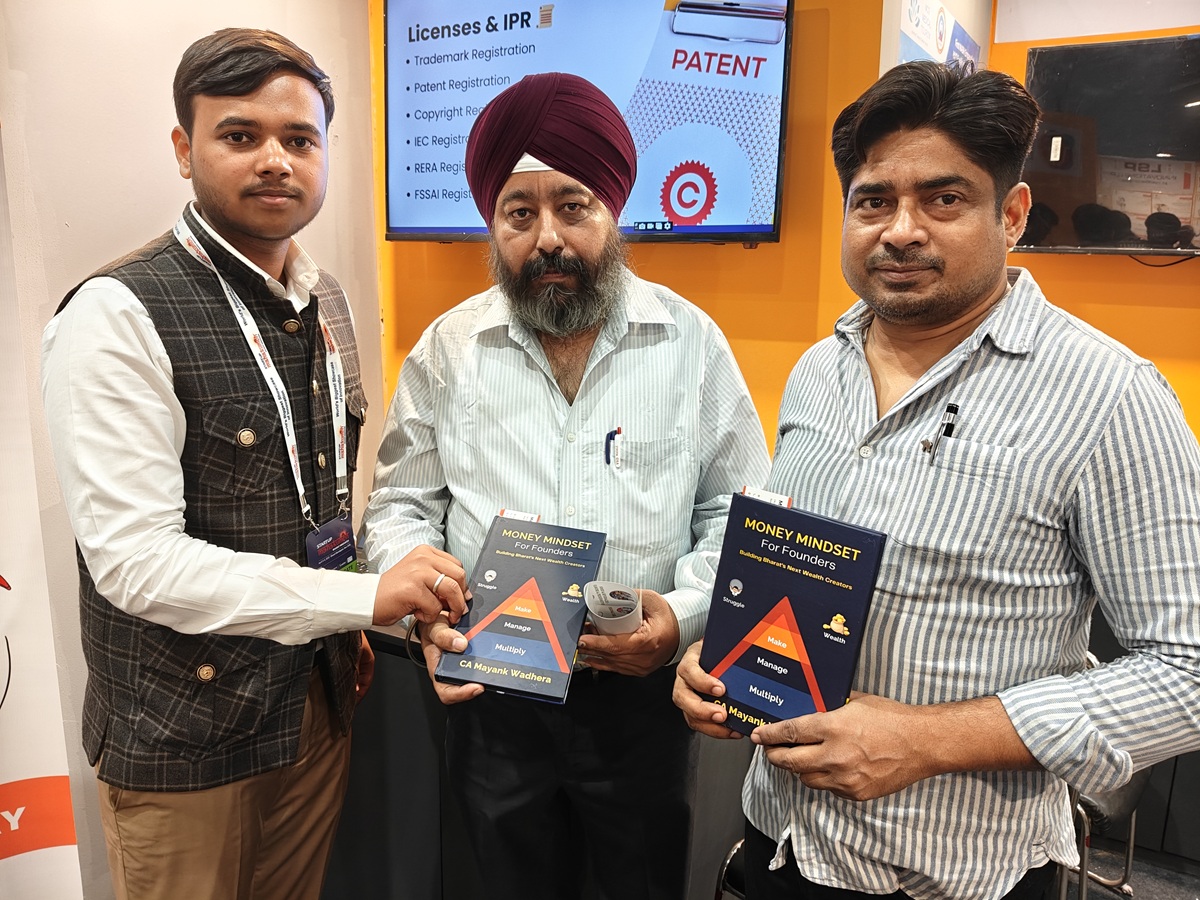

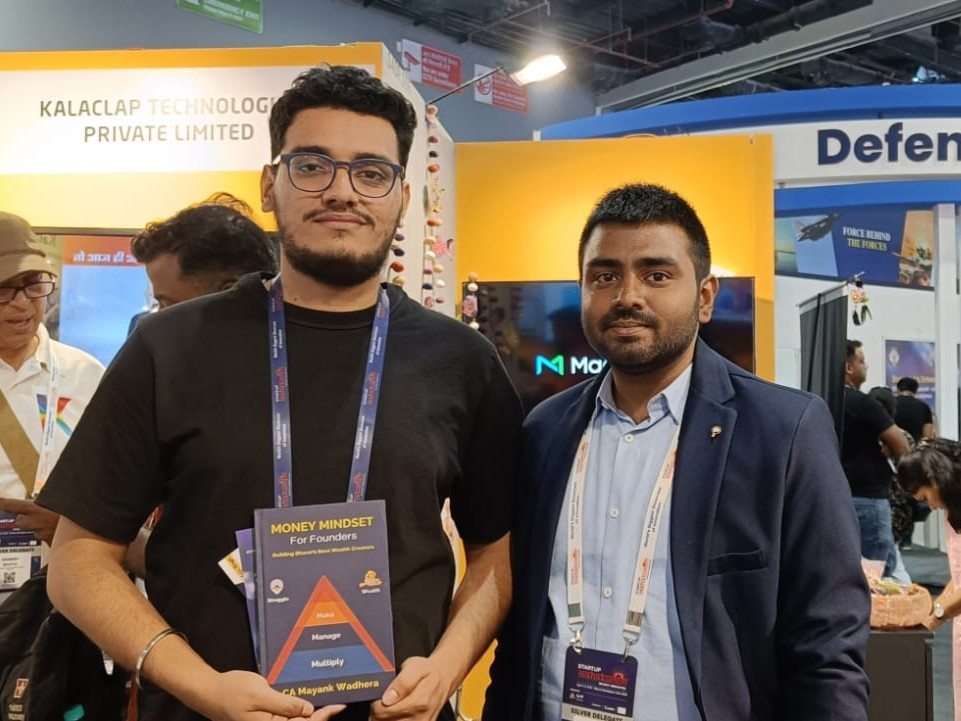

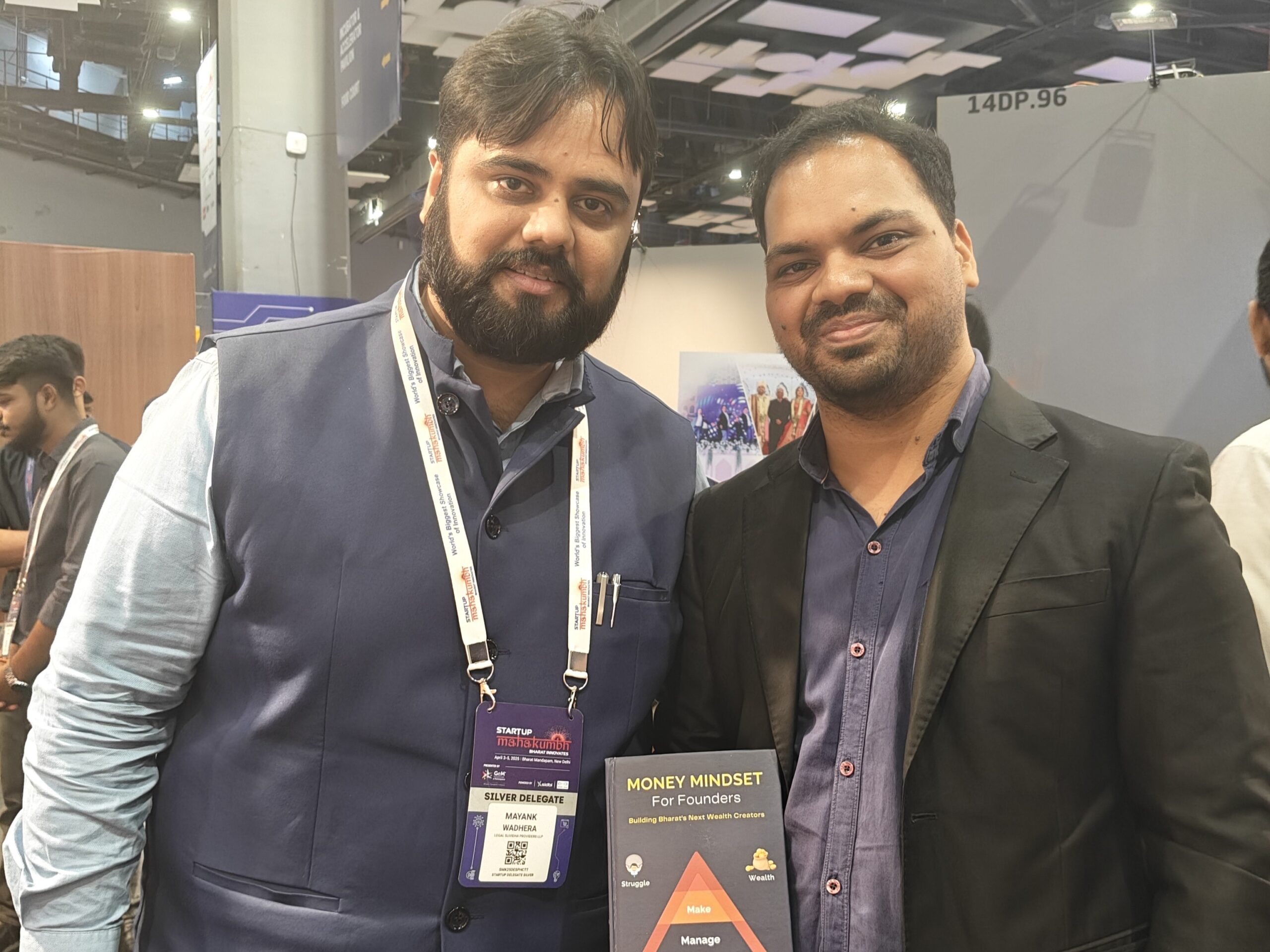

Real People. Real Stories. Real Impact.

Don’t just take our word for it. Here’s what business owners say about our services.

What You Loose If You Not Registering Under Startup India

No Tax Exemption

You lose eligibility for the 3-year income tax holiday under 80-IAC.

Funding Challenges

You miss government-recognized startup tag which VCs prefer.

No Access to Govt Tenders

Most public procurement favors DPIIT-recognized startups.

Missed Schemes

No access to Startup India seed fund, patent rebates & incentives.

Real Case Example

“XYZ Technologies missed DPIIT registration. Despite being innovative and scalable, they lost ₹12L worth of tenders and investor attention.”

Don’t let this happen to your venture.

Every day of delay = More lost opportunities!

Complete Startup India Registration Service in {{mpg_area}}, {{mpg_city}}

Quick Turnaround

We complete the DPIIT registration process within 3–5 working days* after receiving all documents.

Eligibility Guidance

Our experts assess your startup's structure and activities to ensure it qualifies under DPIIT norms.

Application Accuracy

We carefully prepare and review your application to maximize approval chances and less errors.

How Legal Suvidha Makes Startup India Registration Effortless

What You Get With Our Service

- Complete Startup India + DPIIT Registration

- Eligibility Verification & Documentation

- Business Deck/Pitch Help if required

- End-to-End DPIIT Portal Support

- Recognition Certificate Issuance

- Certified CA/CS Guidance

Free Consultation

Our CA expert reviews your company's specific requirements and compliance status.

Documents

We help you gather all necessary documents and information required for filing.

Professional Filing

Our experienced CAs prepare and file all required forms accurately, timely.

Acknowledgment

You receive official acknowledgments and compliance certificates.

Overview of Startup India in {{mpg_area}}, {{mpg_city}}

The Startup India initiative was introduced by the Indian government in 2016.

Its core objective is to boost entrepreneurial growth by supporting new business ventures.

The government has taken several important steps under this scheme to create a strong startup environment and make India a country of job creators rather than job seekers.

- The Department for Promotion of Industry and Internal Trade (DPIIT) governs the Startup India program.

- By establishing work prospects in the Indian economy, the Startup India registration process has extended the scope of development.

- A startup is a new or tiny business that is launched by a single person or a group of people.

- Startup India’s online registration facilitates a smooth process, helping budding entrepreneurs build and scale their ventures.

- Startups under this scheme can enjoy tax breaks, access to funding, and simplified compliance norms.

- In addition, the government provides schemes like the Seed Fund and Credit Guarantee Fund to support startups.

Advantages of Startup India Registration in {{mpg_area}}, {{mpg_city}}

| Tax Advantage | A 3-year income tax holiday is available for eligible startups under the Startup India scheme. They also benefit from angel tax exemptions as per sections 80IAC and 56. |

| Participation in Tender | Startups enjoy relaxation in tender eligibility when applying for government or PSU projects. Startups can participate even without previous work experience or turnover benchmarks. |

| Government Funding Opportunity | A dedicated Rs. 10,000 crore fund is allocated by the government to support startups. Managed by SIDBI, this fund is open to all qualified startups. |

| Participate in Various Government Programmes | Startups can take part in numerous government initiatives designed to foster innovation. Benefits include sustainable finance, credit facilitation, and raw material help. |

| Simple Winding Up | Under the Insolvency and Bankruptcy Code 2016, winding up a startup takes just 90 days. |

| Joining Networks | The scheme helps startups connect with corporate mentors and the wider business community. |

| Self-Certification | They can self-certify under 9 labour and 9 environmental regulations, reducing inspection pressure. |

| Patent Filing Rebate | Startups enjoy an 80% fee waiver on patent applications. |

| Trademark Filing Rebate | A 50% discount on trademark application fees is available to startups. |

Process of Startup India Registration in {{mpg_area}}, {{mpg_city}}

Step 1: Visit the Startup India website:

Head to the Startup India website to begin the registration journey

(https://www.startupindia.gov.in/)

and create your user account.

Step 2: Fill out the registration form:

Next, fill out the online application form for registration.

Submit general information including name, structure, and contact details.

Also include details about the founders and directors.

Step 3: Provide additional documents:

Along with the form, upload supporting documents like your incorporation certificate, business plan, and PAN details.

Step 4: Self-certify compliance:

As part of the process, you need to self-certify adherence to applicable regulations.

Such laws include corporate and tax-related compliance.

Step 5: Submit the registration form:

After reviewing your inputs and uploads, go ahead and submit your form.

Step 6: Get recognized as a startup:

The DPIIT will validate your application and issue official recognition.

You will be issued a certificate of recognition confirming your status.

Documents Required For Startup India Registration in {{mpg_area}}, {{mpg_city}}

Certificate of Registration

To initiate the recognition process, uploading your company’s Certificate of Incorporation is mandatory.

Contact Information

Active phone and email credentials are necessary for verification and updates.

Company Information

Specify your business vertical, industry type, nature of operations, and physical address.

Proof of Concept (If applicable)

Startups with proof of concept must submit media like explainer decks, product demos, or public URLs.

Director/Partner Information

You’ll need to provide full identification details for all founders or partners including name, contact info, and ID proof.

Authorized Representative Information

Mention the identity and contact information of the primary representative of your startup.

Revenue Model & Differentiation

Explain how your business plans to generate revenue and what makes your offering unique in the market.

PAN Details

Provide the startup’s valid PAN to complete financial verification.

Short Business Description

Give a clear and brief description of your startup’s uniqueness and problem-solving capacity.

FAQ's on Startup India Registration in {{mpg_area}}, {{mpg_city}}

Legalsuvidha's Office

Our Credibility:

Helped

6000+ Businesses

Experience

14+ Years

Rating

4.9 / 5 Star

Share this Service:

Why Choose Us?

With a commitment to exceeding expectations and a passion for delivering results, choosing us means choosing a partner dedicated to your success.

Free Legal Advice

We provide free of cost consultation and legal advice to our clients.

Experts Team

We are a team of more than 15+ professionals with 11 years of experience.

Tech Driven Platform

All our services are online no need you to travel from your place.

Transparent pricing

There are no hidden & extra charges* other than the quote/invoice we provide.

100 % Client Satisfaction

We aim that all our customers are fully satisfied with our services.

On-Time Delivery

We value your time and we promise all our services are delivered on time.

Quick Response

We provide free of cost consultation and legal advice to our clients.

Our Testimonials

People Who loved our services!

In this Journey of the past 14+ years, we had gained the trust of many startups, businesses, and professionals in India and stand with a 4.9/5 rating in google reviews.We register business online and save time & paperwork.

Trustindex verifies that the original source of the review is Google. I recently got my trademark registered through Legal Suvidha, and I must say the experience was absolutely seamless. The team was proactive in updating me about every stage of the TM application process and patiently answered all my queries. Highly recommended to any startup or business owner looking for reliable legal and compliance support.Trustindex verifies that the original source of the review is Google. I’ve been working with this firm for the past 3 years, and I couldn’t be more satisfied with their services. Their team has consistently provided accurate, timely, and dependable financial and compliance support. A special thanks to Priyanka and Mayank for their dedication, professionalism, and personal attention to every detail. Highly recommended for anyone looking for reliable services!Trustindex verifies that the original source of the review is Google. I've been working with Priyanka and her team at Legal Suvidha for the past 5 years for my LLP, Adornfx Multimedia. They've consistently provided excellent support, especially with ROC filings. Their service is reliable, timely, and hassle-free. Highly recommended!Trustindex verifies that the original source of the review is Google. I am delighted to share my experience with Legal Suvidha Firm, where professionalism and dedication shine through in every interaction. Having worked with them for the past 3-4 years, I can confidently say that their team is truly exceptional. The commitment they show to their work is truly commendable; they deliver on every promise made without any hint of fraud or dishonesty, which unfortunately is not the case with many firms in the market today. Their integrity sets them apart and gives clients the peace of mind they need when it comes to legal matters or any other certifications. Moreover, I have found their pricing to be very reasonable and reflect the quality of services provided. They offer excellent value for money, ensuring that their clients receive top-notch legal services without breaking the bank. I highly recommend Legal Suvidha Legal Firm without any hesitation. If you’re looking for a reliable legal partner with a dedicated team that truly cares, look no further than Legal Suvidha. My experience has been nothing short of excellent, and I am confident that others will feel the same! For Talin Remedies Pvt Ltd Ravi KumarTrustindex verifies that the original source of the review is Google. One of the easiest firms to work with. Soft-spoken, well aware of their scope of work, and the most affordable (especially for new comers). They're always available to help out giving solutions in the easiest way possible. Got their number from a mentor, and would highly recommend their services if you're looking to start and manage accountancy/compliance related work for your firm!Trustindex verifies that the original source of the review is Google. Mayank & the Legal Suvidha team are fantastic. They really try to understand the business like insiders and don't give you templatized solutions. The staff are extremely supportive and go out of their way to help you. I would recommend Mayank to anybody new to the startup ecosystem!Verified by TrustindexTrustindex verified badge is the Universal Symbol of Trust. Only the greatest companies can get the verified badge who has a review score above 4.5, based on customer reviews over the past 12 months. Read more

Redefining the experience of legal services.

Now all Professional Services in a Single Click !

- Registration/Incorporation for all companies

- Income Tax Filings

- GST Registration & Filing

- Company Annual Filings

- Trademark Registration

- Licensing

Launching Soon!

Stay Updated with Latest News!

Explore more of our blogs to have better clarity and understanding

of the latest corporate & business updates.

5 Essential Legal SaaS Startup Rules: Avoid Penalties Globally

5 Essential Legal SaaS Startup Rules: Avoid Penalties Globally "83% of SaaS Startups Face Legal Action Within First 24 Months"...

5 Essential AI Usage Policy Steps for Startups (+Free Template)

5 Essential AI Usage Policy Steps for Startups (+Free Template) "87% of Startups Using AI Face Legal Blind Spots -...

Avoid Costly Penalties: 2025 Data Transfer Compliance Checklist

Avoid Costly Penalties: 2025 Data Transfer Compliance Checklist 85% of Indian Businesses Aren’t Ready for This Data Regulation Tsunami India’s...

7 Essential AI Compliance Readiness Strategies to Avoid Penalties

7 Essential AI Compliance Readiness Strategies to Avoid Penalties "62% of Indian Businesses Face Regulatory Action Due to Poor AI...

5 Critical Open Source Compliance Do’s and Don’ts (Avoid Legal Blunders)

5 Critical Open Source Compliance Do’s and Don’ts (Avoid Legal Blunders) “83% of Companies Use Open Source Code Without Proper...

5 Critical Differences: Convertible Notes vs. CCDs in 2025 (Tax Risks)

5 Critical Differences: Convertible Notes vs. CCDs in 2025 (Tax Risks) "78% of Startups Face Penalties for Mismanaging Convertible Debt"...