Revenue-Based Financing: Non-Dilutive Capital for Startups

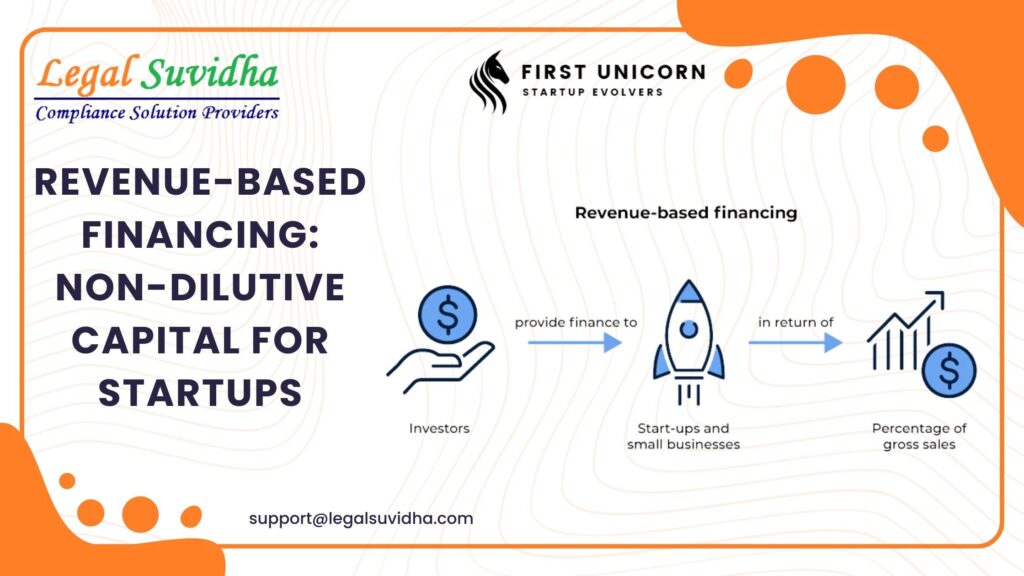

Revenue-Based Financing: Non-Dilutive Capital for Startups Revenue-Based Financing (RBF) is an alternative funding model for startups and small businesses that allows them to raise capital based on their revenue-generating potential, without giving up equity or ownership. In essence, RBF is a form of non-dilutive financing that ties the repayment to a percentage of the company’s […]

Revenue-Based Financing: Non-Dilutive Capital for Startups Read More »